Question: Question Help Consider the following note payable transactions of Creative Video Productions, 2015 Apr 1 Purchased equipment costing $16,000 by issuing a one-year, 6% note

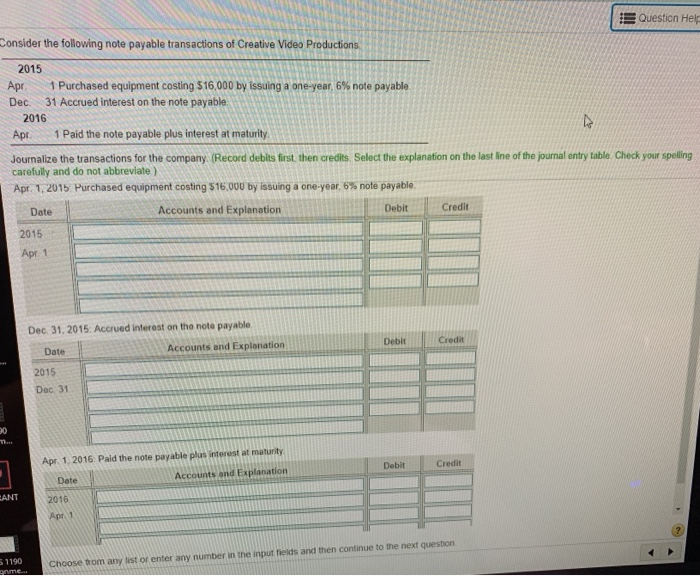

Question Help Consider the following note payable transactions of Creative Video Productions, 2015 Apr 1 Purchased equipment costing $16,000 by issuing a one-year, 6% note payable Dec 31 Accrued interest on the note payable 2016 Apr 1 Paid the note payable plus interest at maturity Journalize the transactions for the company. (Record debits first then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate) Apr 1, 2015 Purchased equipment costing $16.000 by issuing a one-year, 6% note payable Date Accounts and Explanation Debit Credit 2015 Apr. 1 Dec 31, 2015. Accrued interest on the note payable Date Accounts and Explanation Debit Credit 2015 Doc. 31 00 Debit Credit Apr 1, 2016 Paid the note payable plus interest at maturity Date Accounts and Explanation 2016 Apr1 EANT 5 1190 Choose from any list of enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts