Question: Question Help Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital gains and losses on the individual's

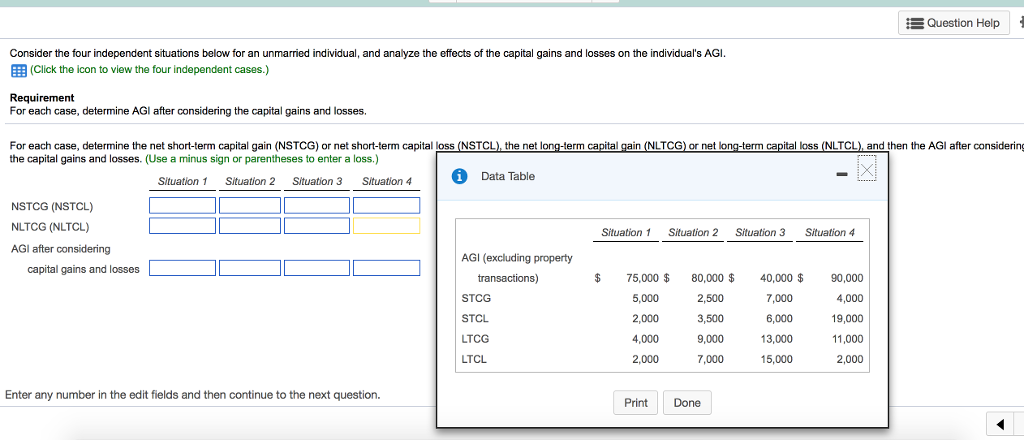

Question Help Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital gains and losses on the individual's AGI (Click the icon to view the four independent cases.) Requirement For each case, determine AGI after considering the capital gains and losses. capital loss (NLTCL), and then the AGI after considering For each case, determine the net short-term capital gain (NSTCG) or net short-term capital loss (NSTCL), the net long-term capital gain (NLTCG)or net the capital gains and losses. (Use a minus sign or parentheses to enter a loss.) Data Table Situation1 Situation 2 Situation 3 Situation 4 NSTCG (NSTCL) NLTCG (NLTCL) AGI after considering Situation1 Situation 2 Situation 3 Situation 4 AGI (excluding property capital gains and losses transactions) STCG STCL LTCG LTCL $ 75,000 $80,000 $40,000 90,000 4,000 19,000 11,000 2,000 5,000 2,000 4,000 2,000 2,500 3,500 9,000 7,000 7,000 6,000 13,000 15,000 Enter any number in the edit fields and then continue to the next question. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts