Question: Question Help Does a fimm classify the acquisition of a plant asset by common stock issuance as both an investing and a financing activity on

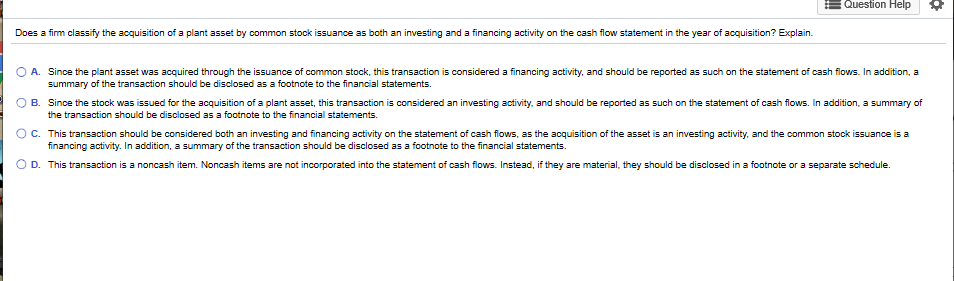

Question Help Does a fimm classify the acquisition of a plant asset by common stock issuance as both an investing and a financing activity on the cash flow statement in the year of acquisition? Explain. O A. Since the plant asset was acquired through the issuance of common stock, this transaction is considered a financing activity, and should be reported as such on the statement of cash flows. In addition, a summary of the transaction should be disclosed as a footnote to the financial statements. O B. Since the stock was issued for the acquisition of a plant asset, this transaction is considered an investing activity, and should be reported as such on the statement of cash flows. In addition, a summary of the transaction should be disclosed as a footnote to the financial statements. Oc. This transaction should be considered both an investing and financing activity on the statement of cash flows, as the acquisition of the asset is an investing activity, and the common stock issuance is a financing activity. In addition, a summary of the transaction should be disclosed as a footnote to the financial statements. OD. This transaction is a noncash item. Noncash items are not incorporated into the statement of cash flows. Instead, if they are material, they should be disclosed in a footnote or a separate schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts