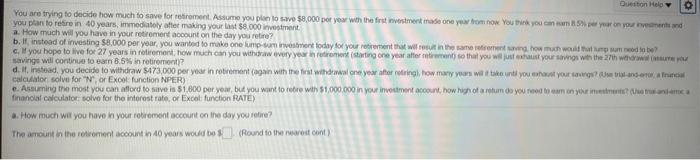

Question: Question Help O You are trying to decide how much to save for retirement Assume you plan to save $8,000 per year with the first

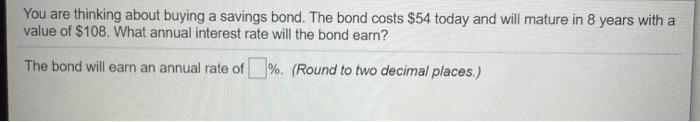

Question Help O You are trying to decide how much to save for retirement Assume you plan to save $8,000 per year with the first investment made one you com now you think you anyar on you need you plan to retire in 40 years, immediately after making your last $8.000 investment a. How much will you have in your retirement account on the day you retire? b. If instead of investing $8,000 per year, you wanted to make one lump som investment today for your retirement that will rest in the same how much that are to be c. you hope to live for 27 years in retirement how much you withdraw every year in from starting one year after so that you will just as your songs with the 27th www savings will continue to earn 8.5% in rotirement? d. It. Instead, you decide to withdraw 5173,000 per year in retirement again with the first wihwalone year after how many years will takout you have your care calculator solve for "Nor Excol function NPER) e. Assuming the most you can afford to save is $1.000 per year, but you want to be WIN 51.000.000 in your investment account,how high of a retum do you read to an on your financial calculator solve for the interest rate of Excel function RATE) How much will you have in your robrement account on the day you retire? The amount in the retromont account in 40 years would be (Round to the nearest cont) You are thinking about buying a savings bond. The bond costs $54 today and will mature in 8 years with a value of $108. What annual interest rate will the bond earn? The bond will earn an annual rate of %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts