Question: Question Help On December 31, Barrera Company estimates that it will pay its employees a 6% bonus on net income after deducting the bonus. The

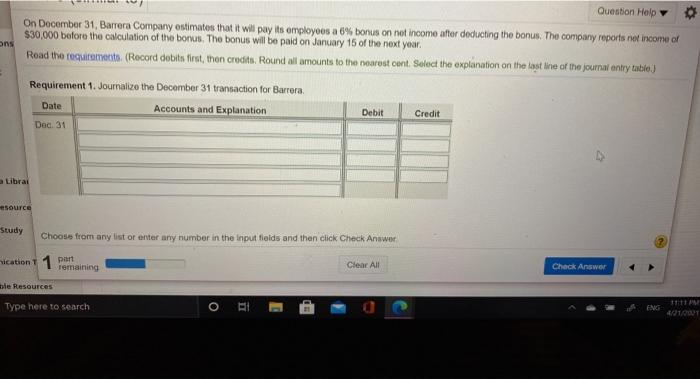

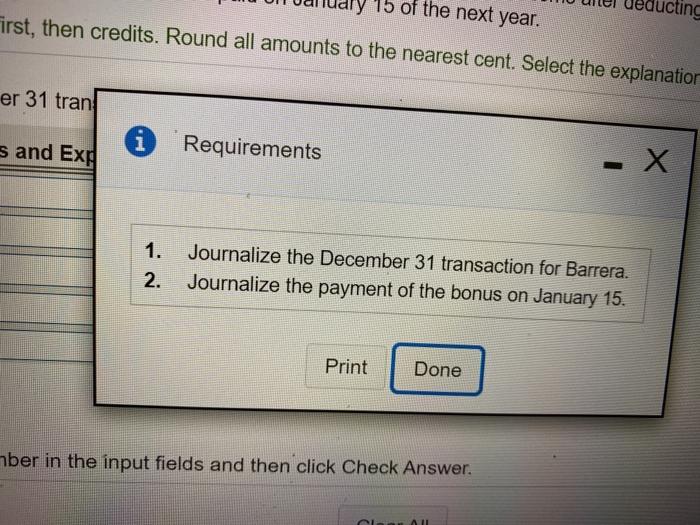

Question Help On December 31, Barrera Company estimates that it will pay its employees a 6% bonus on net income after deducting the bonus. The company reports net income of $30,000 before the calculation of the bonus. The bonus will be paid on January 15 of the next year Read the requirements (Record debits first, then credito. Round all amounts to the nearest cont. Select the explanation on the last line of the journal entry table.) ons Requirement 1. Journalize the December 31 transaction for Barrera. Date Accounts and Explanation Dec 31 Debit Credit Librai esource Study Choose from any list or enter any number in the input fields and then click Check Answer nication 1 pant remaining Clear All Check Answer ble Resources Type here to search O 421/OUT 15 of the next year. educting irst, then credits. Round all amounts to the nearest cent. Select the explanatior er 31 tran s and Exp i Requirements 1. 2. Journalize the December 31 transaction for Barrera. Journalize the payment of the bonus on January 15. Print Done mber in the input fields and then click Check Answer. A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts