Question: Question Help Probst Company exchanged a used machine with a book value of $26,100 (cost $54,300 less $28,200 accumulated depreciation) and cash of $8,400 for

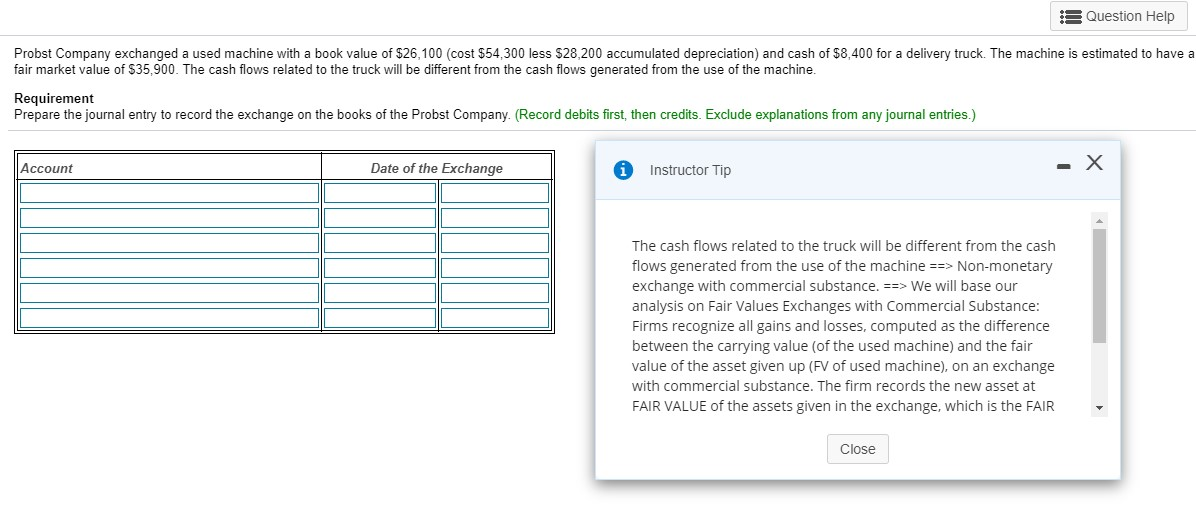

Question Help Probst Company exchanged a used machine with a book value of $26,100 (cost $54,300 less $28,200 accumulated depreciation) and cash of $8,400 for a delivery truck. The machine is estimated to have a fair market value of $35,900. The cash flows related to the truck will be different from the cash flows generated from the use of the machine. Requirement Prepare the journal entry to record the exchange on the books of the Probst Company. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Date of the Exchange 0 Instructor Tip - X The cash flows related to the truck will be different from the cash flows generated from the use of the machine ==> Non-monetary exchange with commercial substance. ==> We will base our analysis on Fair Values Exchanges with Commercial Substance: Firms recognize all gains and losses, computed as the difference between the carrying value of the used machine) and the fair value of the asset given up (FV of used machine), on an exchange with commercial substance. The firm records the new asset at FAIR VALUE of the assets given in the exchange, which is the FAIR Close

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts