Question: Question Help Tem cash Replacement decision Industries is considering replacing a fully deprecated machine that has a remaining useful le of 10 years with a

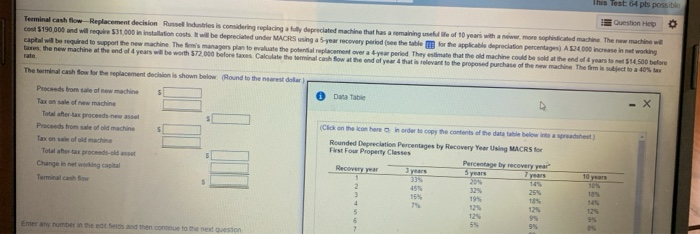

Question Help Tem cash Replacement decision Industries is considering replacing a fully deprecated machine that has a remaining useful le of 10 years with a new, more sophisticated machine The new machine we Co 5190 000 and will require 531000 in installation costs. It will be depreciated under MACRS using a 5-year recovery period see the table for the applicable depreciation percent A n cesi o g callbered to support the new machine Thes e plan to the p l anetowaty period They estimate that the old machine de sold the end of years to $14.500 before the new machine the end of 4 years be worth $72.000 before wes Calculate the cash fow at the end of year that is relevant to the proposed purchase of the new machine The firm is s et to a 40% The in f o for the placement decision is shown below Round to the do Proceeds from sale of new machine s Total hertax proceeds new asset Click on the home to copy the comes of the datab a se Rounded Depreciation Percentages by Recovery Year Using MACRS for Four Property Classes Tax on sale of machine Change in wong capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts