Question: Question Help TRA Lori and Peter enter into a partnership and decide to share profits and losses as follows: 1. The first allocation is a

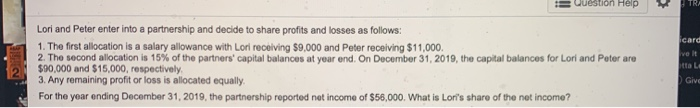

Question Help TRA Lori and Peter enter into a partnership and decide to share profits and losses as follows: 1. The first allocation is a salary allowance with Lori receiving $9,000 and Peter receiving $11,000. 2 The second allocation is 15% of the partners' capital balances at year end. On December 31, 2019, the capital balances for Lori and Peter are 3. Any remaining profit or loss is allocated equally For the year ending December 31, 2019, the partnership reported net income of $58,000. What is Lor's share of the net income? card helt ta L Give

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock