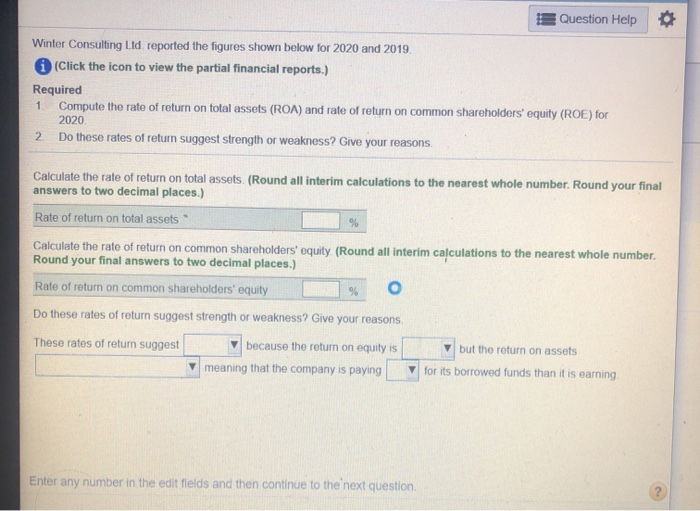

Question: Question Help Winter Consulting Lid reported the figures shown below for 2020 and 2019 (Click the icon to view the partial financial reports.) Required Compute

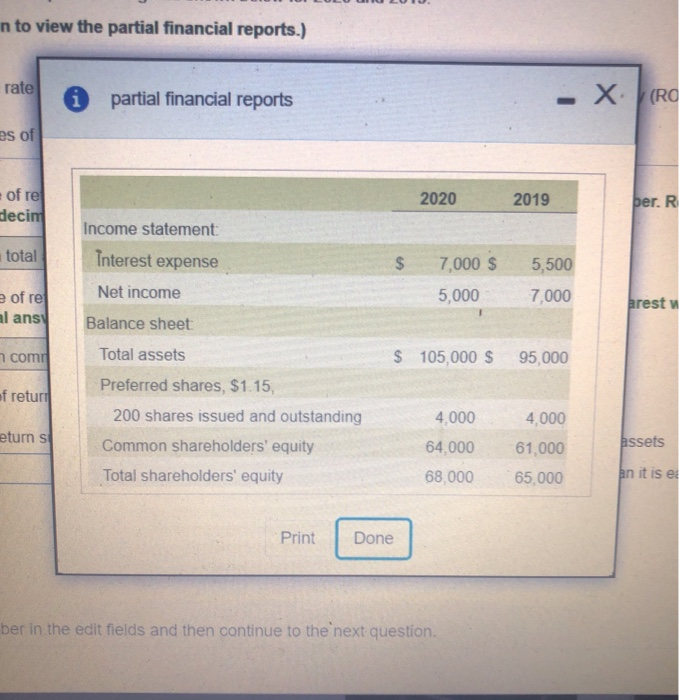

Question Help Winter Consulting Lid reported the figures shown below for 2020 and 2019 (Click the icon to view the partial financial reports.) Required Compute the rate of return on total assets (ROA) and rate of return on common shareholders' equity (ROE) for 2020 2 Do these rates of return suggest strength or weakness? Give your reasons. 1 Calculate the rate of return on total assets. (Round all interim calculations to the nearest whole number. Round your final answers to two decimal places.) Rate of return on total assets % Calculate the rate of return on common shareholders' equity (Round all interim calculations to the nearest whole number Round your final answers to two decimal places.) Rate of return on common shareholders' equity % o Do these rates of return suggest strength or weakness? Give your reasons These rates of return suggest because the return on equity is but the return on assets meaning that the company is paying for its borrowed funds than it is earning Enter any number in the edit fields and then continue to the next question in to view the partial financial reports.) rate i partial financial reports - X (RO es of of re 2020 2019 ber. R decin Income statement: total Interest expense $ 5,500 7,000 $ 5,000 Net income 7,000 e ofre al ans arest Balance sheet 7 comi Total assets $ 105,000 $ 95,000 of returi 4,000 eturns Preferred shares, $1.15, 200 shares issued and outstanding Common shareholders' equity Total shareholders' equity 4,000 64,000 61,000 assets 68,000 65.000 an it is e Print Done ber in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts