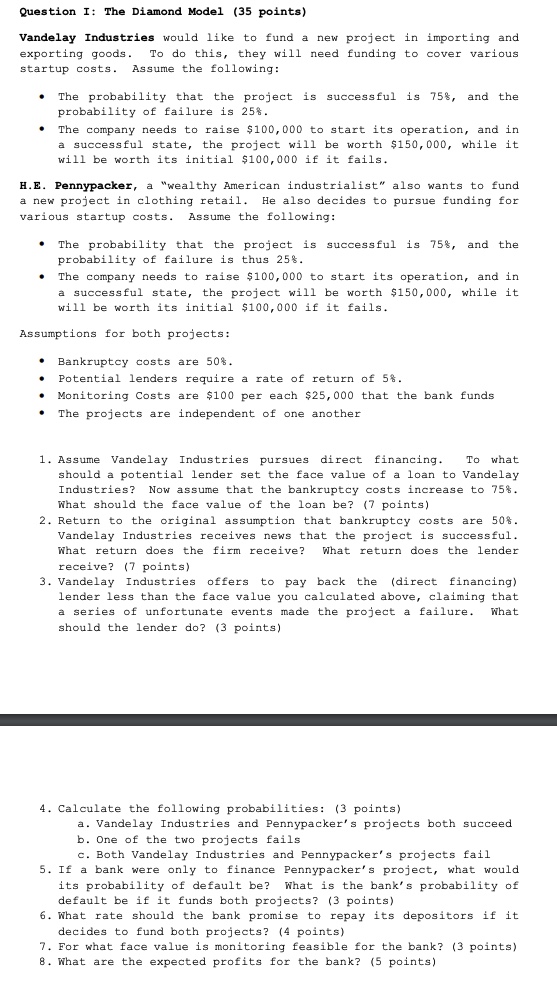

Question: Question I: The Diamond Model ( 3 5 points ) Vandelay Industries would like to fund a new project in importing and exporting goods. To

Question I: The Diamond Model points

Vandelay Industries would like to fund a new project in importing and

exporting goods. To do this, they will need funding to cover various

startup costs. Assume the following:

The probability that the project is successful is and the

probability of failure is

The company needs to raise $ to start its operation, and in

a successful state, the project will be worth $ while it

will be worth its initial $ if it fails.

HE Pennypacker, a "wealthy American industrialist" also wants to fund

a new project in clothing retail. He also decides to pursue funding for

various startup costs. Assume the following:

The probability that the project is successful is and the

probability of failure is thus

The company needs to raise $ to start its operation, and in

a successful state, the project will be worth $ while it

will be worth its initial $ if it fails.

Assumptions for both projects:

Bankruptcy costs are

Potential lenders require a rate of return of

Monitoring Costs are $ per each $ that the bank funds

The projects are independent of one another

Assume Vandelay Industries pursues direct financing. To what

should a potential lender set the face value of a loan to Vandelay

Industries? Now assume that the bankruptcy costs increase to

What should the face value of the loan be points

Return to the original assumption that bankruptcy costs are

Vandelay Industries receives news that the project is successful.

What return does the firm receive? What return does the lender

receive? points

Vandelay Industries offers to pay back the direct financing

lender less than the face value you calculated above, claiming that

a series of unfortunate events made the project a failure. What

should the lender do points

Calculate the following probabilities: points

a Vandelay Industries and Pennypacker's projects both succeed

b One of the two projects fails

c Both Vandelay Industries and Pennypacker's projects fail

If a bank were only to finance Pennypacker's project, what would

its probability of default be What is the bank's probability of

default be if it funds both projects? points

What rate should the bank promise to repay its depositors if it

decides to fund both projects? points

For what face value is monitoring feasible for the bank? points

What are the expected profits for the bank? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock