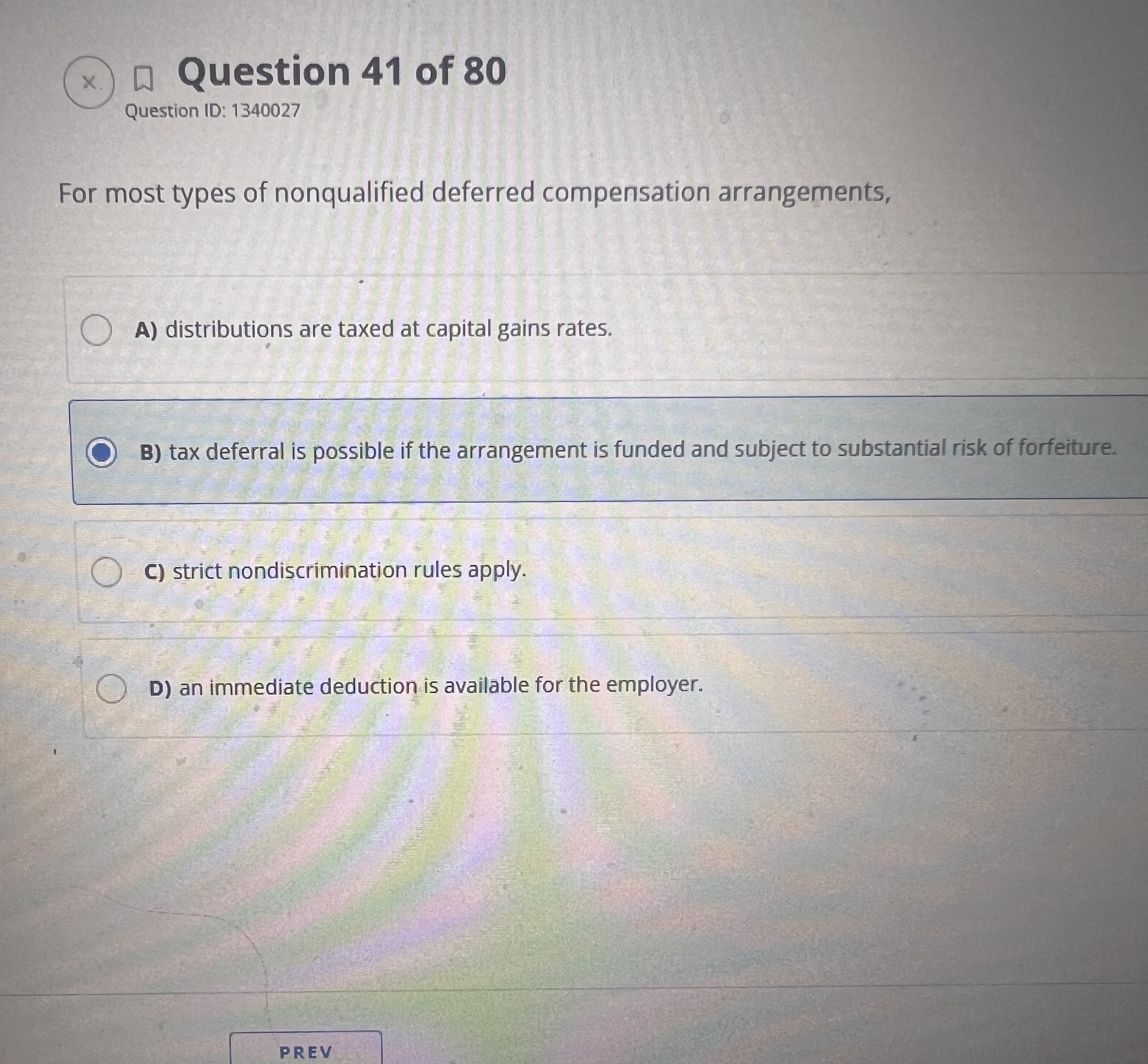

Question: Question ID: 1 3 4 0 0 2 7 For most types of nonqualified deferred compensation arrangements,A ) distributions are taxed at capital gains rates.B

Question ID:

For most types of nonqualified deferred compensation arrangements,A distributions are taxed at capital gains rates.B tax deferral is possible if the arrangement is funded and subject to substantial risk of forfeiture.C strict nondiscrimination rules apply.D an immediate deduction is available for the employer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock