Question: question in computer science Write down the monetary equation of exchange in levels ( multiplicative form ) and separately in terms of growth rates (

question in computer science

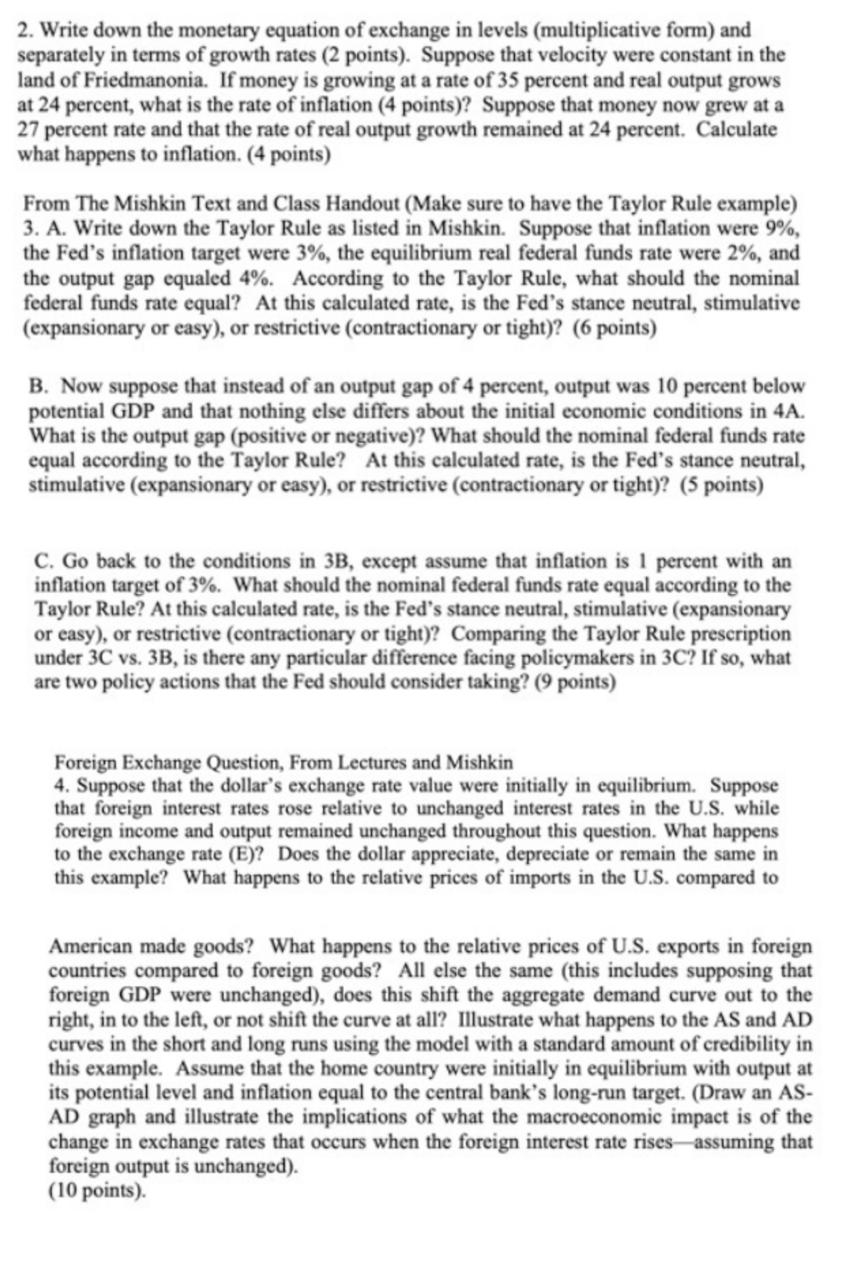

Write down the monetary equation of exchange in levels multiplicative form and separately in terms of growth rates points Suppose that velocity were constant in the land of Friedmanonia. If money is growing at a rate of percent and real output grows at percent, what is the rate of inflation points Suppose that money now grew at a percent rate and that the rate of real output growth remained at percent. Calculate what happens to inflation. points

From The Mishkin Text and Class Handout Make sure to have the Taylor Rule example A Write down the Taylor Rule as listed in Mishkin. Suppose that inflation were the Fed's inflation target were the equilibrium real federal funds rate were and the output gap equaled According to the Taylor Rule, what should the nominal federal funds rate equal? At this calculated rate, is the Fed's stance neutral, stimulative expansionary or easy or restrictive contractionary or tight points

B Now suppose that instead of an output gap of percent, output was percent below potential GDP and that nothing else differs about the initial economic conditions in A What is the output gap positive or negative What should the nominal federal funds rate equal according to the Taylor Rule? At this calculated rate, is the Fed's stance neutral, stimulative expansionary or easy or restrictive contractionary or tight points

C Go back to the conditions in B except assume that inflation is percent with an inflation target of What should the nominal federal funds rate equal according to the Taylor Rule? At this calculated rate, is the Fed's stance neutral, stimulative expansionary or easy or restrictive contractionary or tight Comparing the Taylor Rule preseription under vs is there any particular difference facing policymakers in If so what are two policy actions that the Fed should consider taking? points

Foreign Exchange Question, From Lectures and Mishkin

Suppose that the dollar's exchange rate value were initially in equilibrium. Suppose that foreign interest rates rose relative to unchanged interest rates in the US while foreign income and output remained unchanged throughout this question. What happens to the exchange rate E Does the dollar appreciate, depreciate or remain the same in this example? What happens to the relative prices of imports in the US compared to

American made goods? What happens to the relative prices of US exports in foreign countries compared to foreign goods? All else the same this includes supposing that foreign GDP were unchanged does this shift the aggregate demand curve out to the right, in to the left, or not shift the curve at all? Illustrate what happens to the AS and AD curves in the short and long runs using the model with a standard amount of credibility in this example. Assume that the home country were initially in equilibrium with output at its potential level and inflation equal to the central bank's longrun target. Draw an ASAD graph and illustrate the implications of what the macroeconomic impact is of the change in exchange rates that occurs when the foreign interest rate rises assuming that foreign output is unchanged

points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock