Question: Question: Industry demand has been revised and is now projected to reach 9 million units, up from the original forecast of 8 million. Dani is

Question: Industry demand has been revised and is now projected to reach 9 million units, up from the original forecast of 8 million. Dani is considering raising her advertising expenditures by $500,000.

1. How will this change in advertising expenditures affect Whoyser's volume and break-even projections?

2. Under the changed market forecast and with the change in advertising expenditures what will Dani's break-even market share?

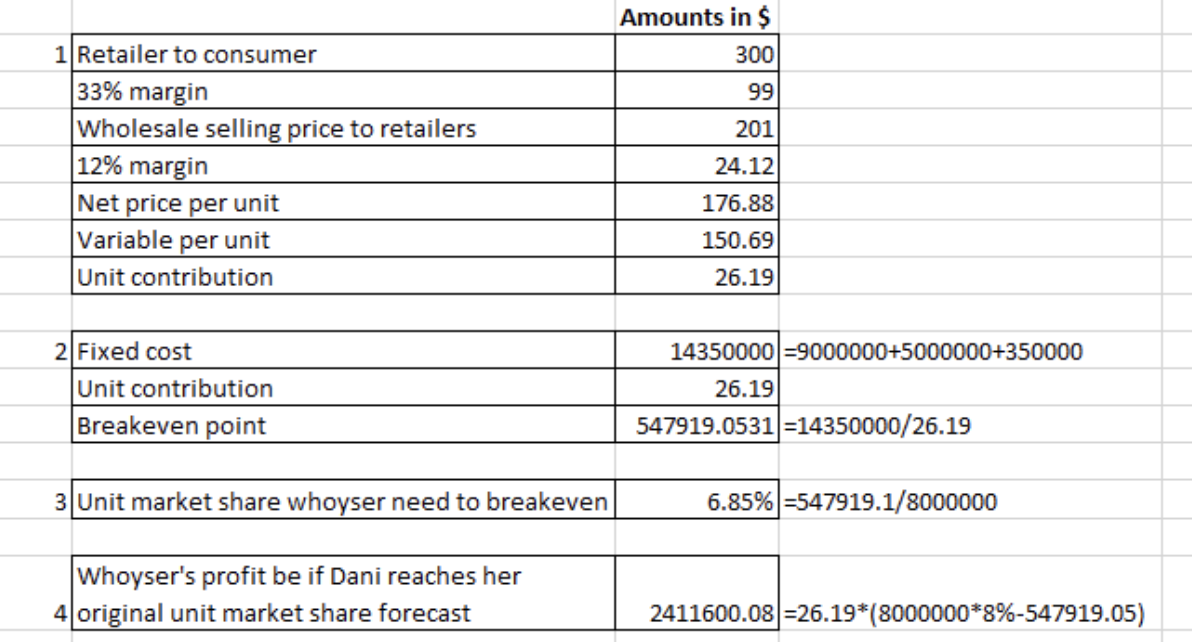

The GoGo had been variously described as combination of a hoverboard and a self-driving scooter. Weighing 18 pounds, it would be sold through wholesale distributors to retailers who would sell to final consumers. The GoGo would be initially priced at retail for $300.00. After discounts for distribution, the GoGo would deliver to Whoyser $176.88 revenue per unit. The $300 retail price was believed to be exceptionally low compared to early versions of the Segway Personal Transporter, which had been priced at around $5000. The market for the GoGo and its direct competitors was forecast to be 8,000,000 units annually in the GoGo's first selling year. Whoyser had direct variable manufacturing costs of $127.00 per GoGo, coupled with fixed manufacturing costs of $9,000,000 The annual advertising budget for the GoGo was $5,000,000. Direct management salaries and expenses totaled $350,000. The GoGo salespeople working for Whoyser were paid solely by a 10% commission on Whoyser's sales. Shipping costs, breakage and insurance were forecast to be $6.00 per unit. Amounts in $ 300 99 201 1 Retailer to consumer 33% margin Wholesale selling price to retailers 12% margin Net price per unit Variable per unit Unit contribution 24.12 176.88 150.69 26.19 14350000 =9000000+5000000+350000 2 Fixed cost Unit contribution Breakeven point 26.19 547919.0531 =14350000/26.19 3 Unit market share whoyser need to breakeven 6.85% =547919.1/8000000 Whoyser's profit be if Dani reaches her 4 original unit market share forecast 2411600.08 =26.19*(8000000*8%-547919.05) The GoGo had been variously described as combination of a hoverboard and a self-driving scooter. Weighing 18 pounds, it would be sold through wholesale distributors to retailers who would sell to final consumers. The GoGo would be initially priced at retail for $300.00. After discounts for distribution, the GoGo would deliver to Whoyser $176.88 revenue per unit. The $300 retail price was believed to be exceptionally low compared to early versions of the Segway Personal Transporter, which had been priced at around $5000. The market for the GoGo and its direct competitors was forecast to be 8,000,000 units annually in the GoGo's first selling year. Whoyser had direct variable manufacturing costs of $127.00 per GoGo, coupled with fixed manufacturing costs of $9,000,000 The annual advertising budget for the GoGo was $5,000,000. Direct management salaries and expenses totaled $350,000. The GoGo salespeople working for Whoyser were paid solely by a 10% commission on Whoyser's sales. Shipping costs, breakage and insurance were forecast to be $6.00 per unit. Amounts in $ 300 99 201 1 Retailer to consumer 33% margin Wholesale selling price to retailers 12% margin Net price per unit Variable per unit Unit contribution 24.12 176.88 150.69 26.19 14350000 =9000000+5000000+350000 2 Fixed cost Unit contribution Breakeven point 26.19 547919.0531 =14350000/26.19 3 Unit market share whoyser need to breakeven 6.85% =547919.1/8000000 Whoyser's profit be if Dani reaches her 4 original unit market share forecast 2411600.08 =26.19*(8000000*8%-547919.05)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts