Question: Question Information provided for solution That should be a minimum of 7 pages, plus supporting material, and preferably no more than 10 pages. Steps are

Question

Information provided for solution

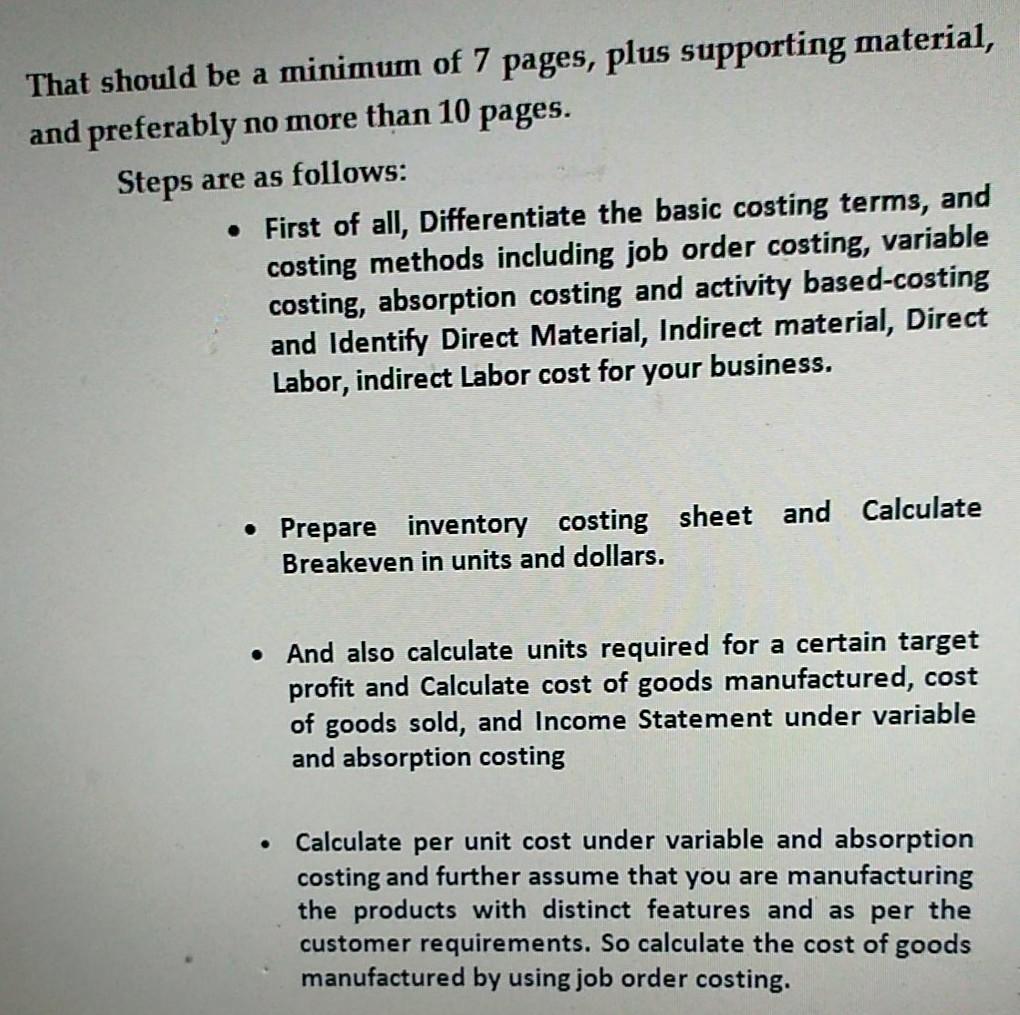

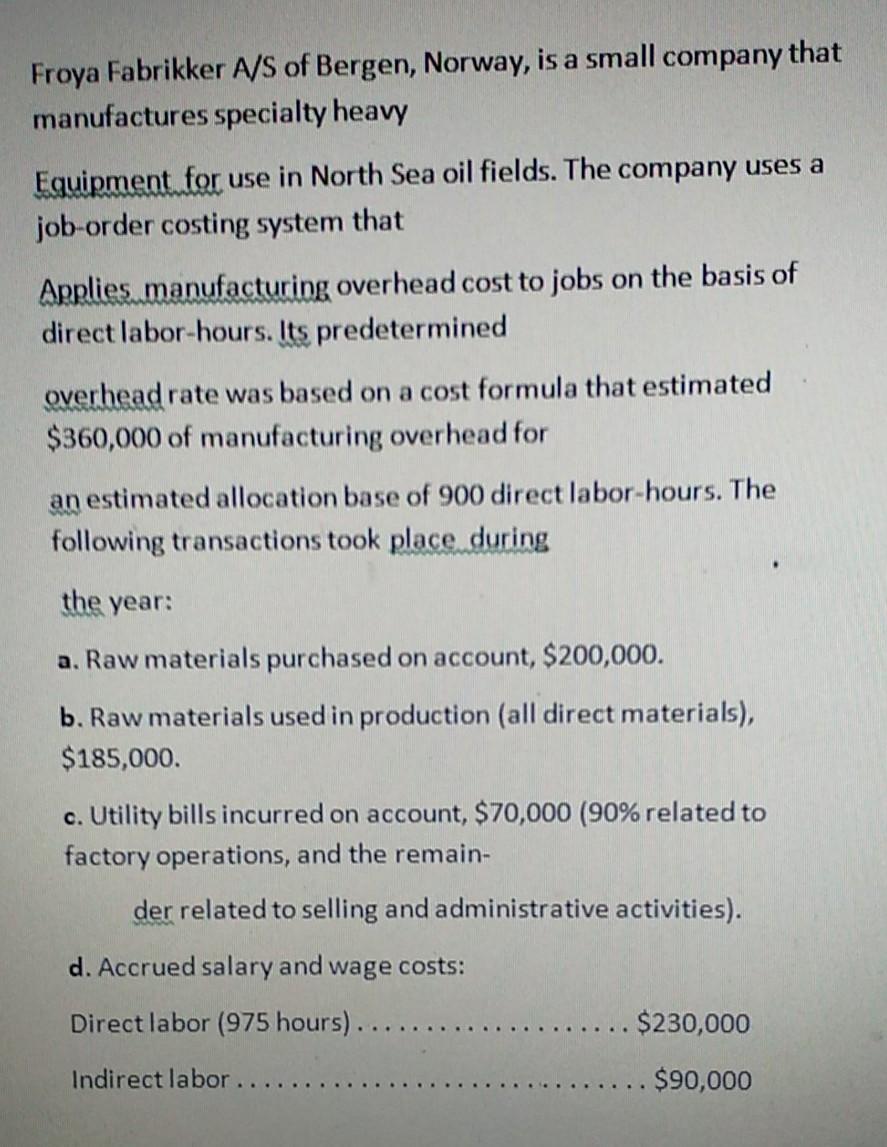

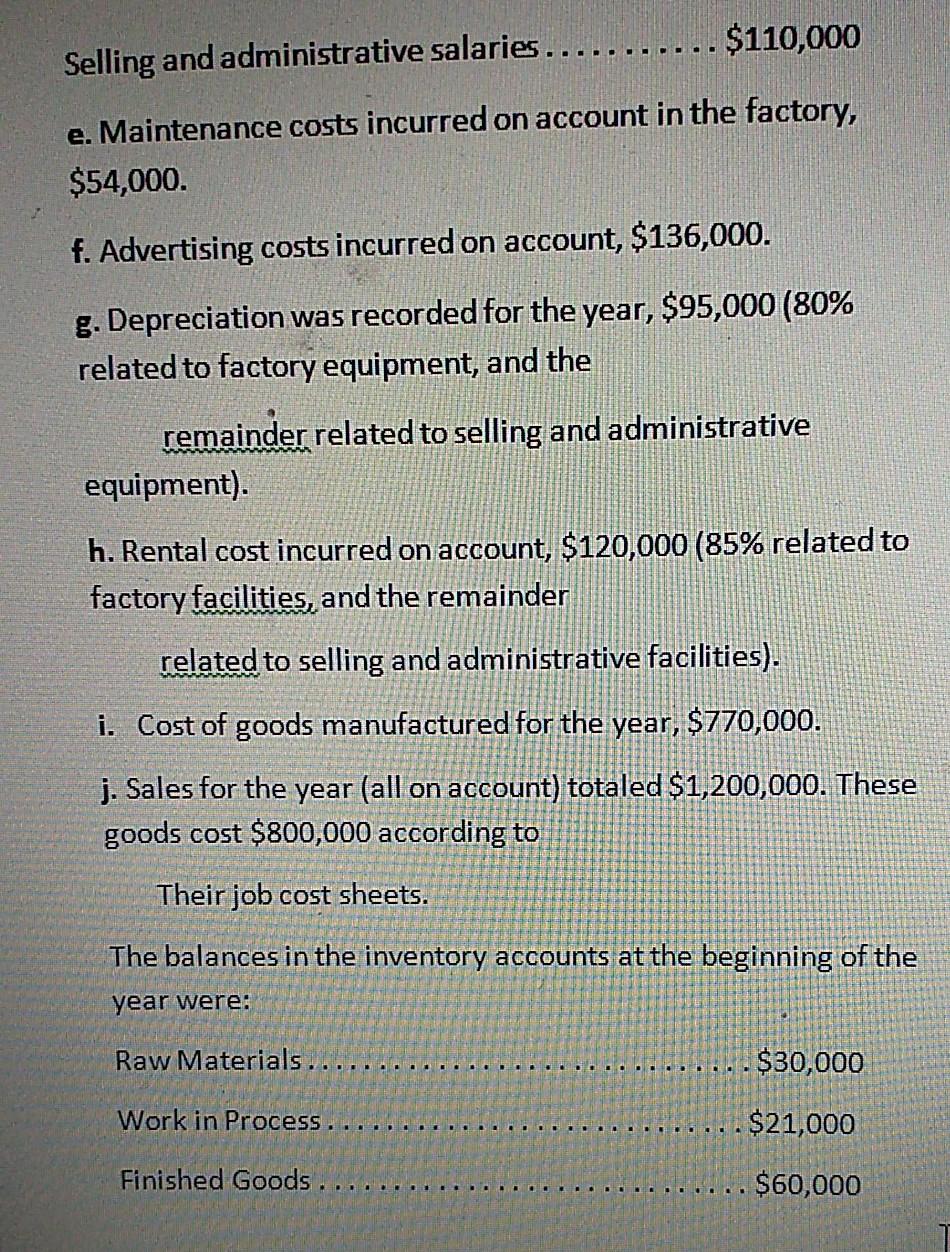

That should be a minimum of 7 pages, plus supporting material, and preferably no more than 10 pages. Steps are as follows: . First of all, Differentiate the basic costing terms, and costing methods including job order costing, variable costing, absorption costing and activity based-costing and Identify Direct Material, Indirect material, Direct Labor, indirect Labor cost for your business. Prepare inventory costing sheet and Calculate Breakeven in units and dollars. And also calculate units required for a certain target profit and Calculate cost of goods manufactured, cost of goods sold, and Income Statement under variable and absorption costing Calculate per unit cost under variable and absorption costing and further assume that you are manufacturing the products with distinct features and as per the customer requirements. So calculate the cost of goods manufactured by using job order costing. Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy Equipment for use in North Sea oil fields. The company uses a job-order costing system that Applies.manufacturing overhead cost to jobs on the basis of direct labor-hours. Its predetermined overhead rate was based on a cost formula that estimated $360,000 of manufacturing overhead for an estimated allocation base of 900 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $200,000. b. Raw materials used in production (all direct materials), $185,000. c. Utility bills incurred on account, $70,000 (90% related to factory operations, and the remain- der related to selling and administrative activities). d. Accrued salary and wage costs: Direct labor (975 hours).. . $230,000 $90,000 Indirect labor.. $110,000 Selling and administrative salaries.... e. Maintenance costs incurred on account in the factory, $54,000. f. Advertising costs incurred on account, $136,000. g. Depreciation was recorded for the year, $95,000 (80% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $120,000 (85% related to factory facilities, and the remainder related to selling and administrative facilities). i. Cost of goods manufactured for the year, $770,000. j. Sales for the year (all on account) totaled $1,200,000. These goods cost $800,000 according to Their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Raw Materials. $30,000 Work in Process. $21,000 Finished Goods . $60,000 That should be a minimum of 7 pages, plus supporting material, and preferably no more than 10 pages. Steps are as follows: . First of all, Differentiate the basic costing terms, and costing methods including job order costing, variable costing, absorption costing and activity based-costing and Identify Direct Material, Indirect material, Direct Labor, indirect Labor cost for your business. Prepare inventory costing sheet and Calculate Breakeven in units and dollars. And also calculate units required for a certain target profit and Calculate cost of goods manufactured, cost of goods sold, and Income Statement under variable and absorption costing Calculate per unit cost under variable and absorption costing and further assume that you are manufacturing the products with distinct features and as per the customer requirements. So calculate the cost of goods manufactured by using job order costing. Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy Equipment for use in North Sea oil fields. The company uses a job-order costing system that Applies.manufacturing overhead cost to jobs on the basis of direct labor-hours. Its predetermined overhead rate was based on a cost formula that estimated $360,000 of manufacturing overhead for an estimated allocation base of 900 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $200,000. b. Raw materials used in production (all direct materials), $185,000. c. Utility bills incurred on account, $70,000 (90% related to factory operations, and the remain- der related to selling and administrative activities). d. Accrued salary and wage costs: Direct labor (975 hours).. . $230,000 $90,000 Indirect labor.. $110,000 Selling and administrative salaries.... e. Maintenance costs incurred on account in the factory, $54,000. f. Advertising costs incurred on account, $136,000. g. Depreciation was recorded for the year, $95,000 (80% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $120,000 (85% related to factory facilities, and the remainder related to selling and administrative facilities). i. Cost of goods manufactured for the year, $770,000. j. Sales for the year (all on account) totaled $1,200,000. These goods cost $800,000 according to Their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Raw Materials. $30,000 Work in Process. $21,000 Finished Goods . $60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts