Question: question is about the GARCH(1,1) model. Show your working. Explain briefly: (a) the GARCH(1,1) model's assumptions, model parameters, and output (3 marks) (b) why GARCH(1,1)

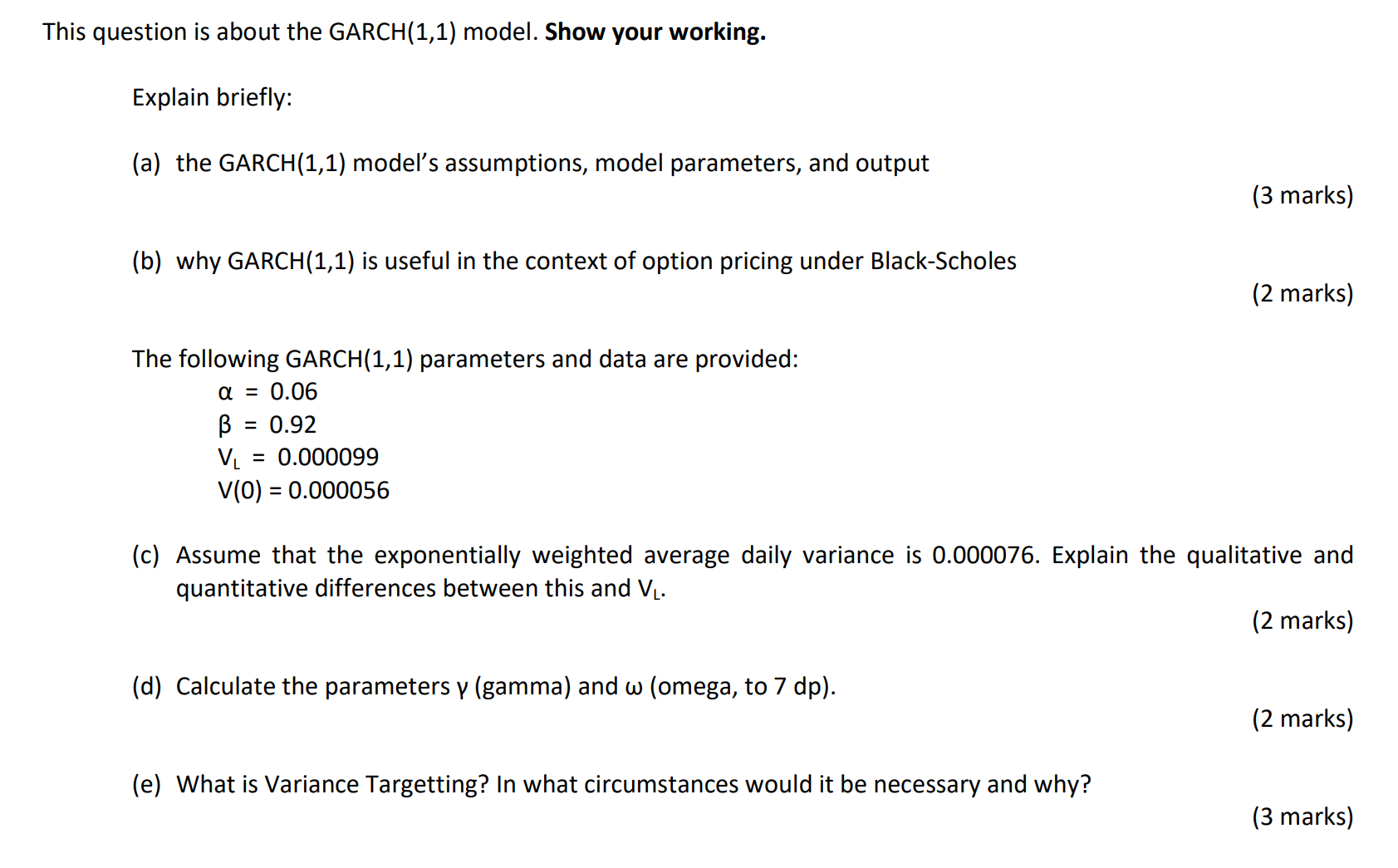

question is about the GARCH(1,1) model. Show your working. Explain briefly: (a) the GARCH(1,1) model's assumptions, model parameters, and output (3 marks) (b) why GARCH(1,1) is useful in the context of option pricing under Black-Scholes (2 marks) The following GARCH(1,1) parameters and data are provided: =0.06=0.92VL=0.000099V(0)=0.000056 (c) Assume that the exponentially weighted average daily variance is 0.000076. Explain the qualitative and quantitative differences between this and VL. (2 marks) (d) Calculate the parameters (gamma) and (omega, to 7dp ). (2 marks) (e) What is Variance Targetting? In what circumstances would it be necessary and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts