Question: question is already complete, instead of factor table, we can use excel function. View Policies Current Attempt in Progress Teal Mountain Company leased equipment from

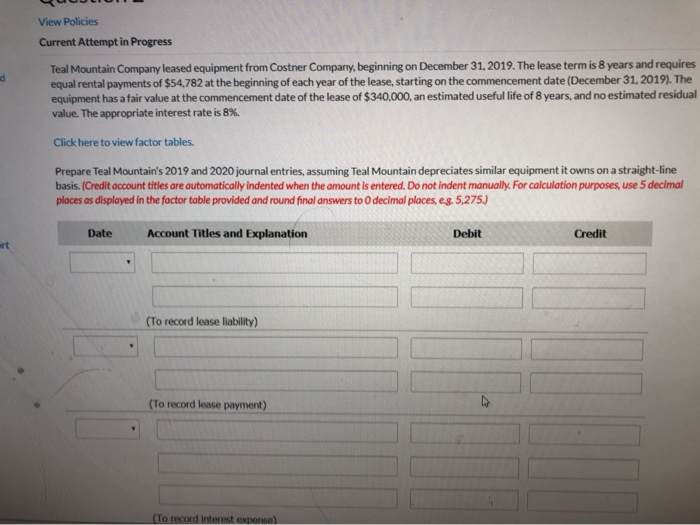

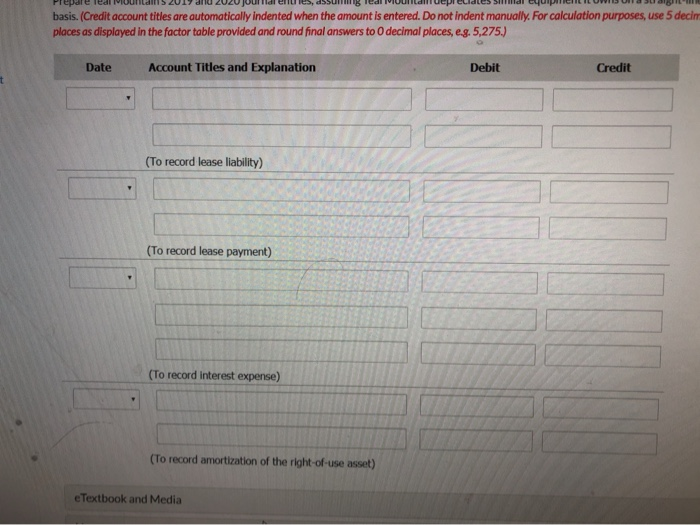

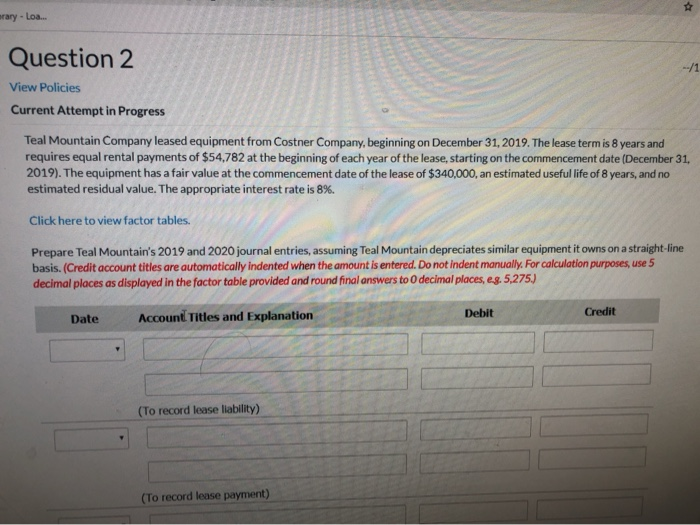

View Policies Current Attempt in Progress Teal Mountain Company leased equipment from Costner Company, beginning on December 31, 2019. The lease term is 8 years and requires equal rental payments of $54,782 at the beginning of each year of the lease, starting on the commencement date (December 31, 2019). The equipment has a fair value at the commencement date of the lease of $340,000, an estimated useful life of 8 years, and no estimated residual value. The appropriate interest rate is 8%. Click here to view factor tables. Prepare Teal Mountain's 2019 and 2020 journal entries, assuming Teal Mountain depreciates similar equipment it owns on a straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places, c.8.5,275.) Date Account Titles and Explanation Debit Credit (To record lease liability) (To record lease payment) To record interesten 2017 al 2020 JUUdien is, d550MB led MUUNDUepi cuides Sidi Lyuipment ILUWIS UN BIL Prepare led MUN basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decin places as displayed in the factor table provided and round final answers to decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit (To record lease liability) (To record lease payment) (To record interest expense) (To record amortization of the right-of-use asset) e Textbook and Media orary - Loa... Question 2 View Policies Current Attempt in Progress Teal Mountain Company leased equipment from Costner Company, beginning on December 31, 2019. The lease term is 8 years and requires equal rental payments of $54.782 at the beginning of each year of the lease, starting on the commencement date (December 31. 2019). The equipment has a fair value at the commencement date of the lease of $340,000, an estimated useful life of 8 years, and no estimated residual value. The appropriate interest rate is 8%. Click here to view factor tables. Prepare Teal Mountain's 2019 and 2020 journal entries, assuming Teal Mountain depreciates similar equipment it owns on a straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places, e.. 5,275) Date Account Titles and Explanation Debit Credit (To record lease liability) (To record lease payment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts