Question: question is in the first one and this one and thank you in advance!!!! Question 6 of 7 -12 View Policies Current Attempt in Progress

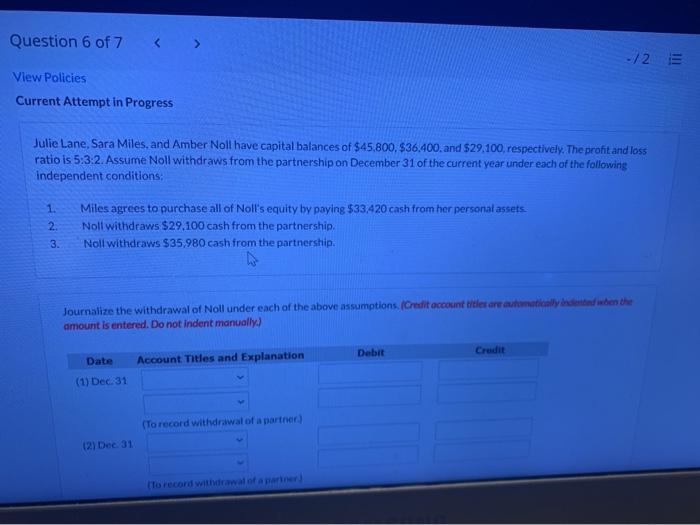

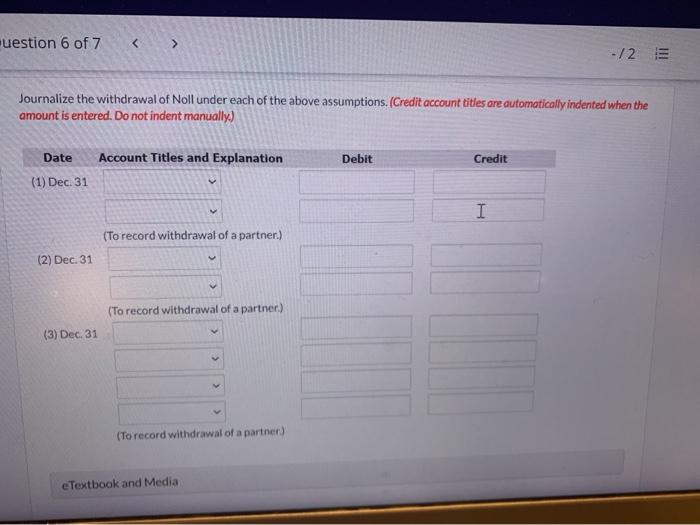

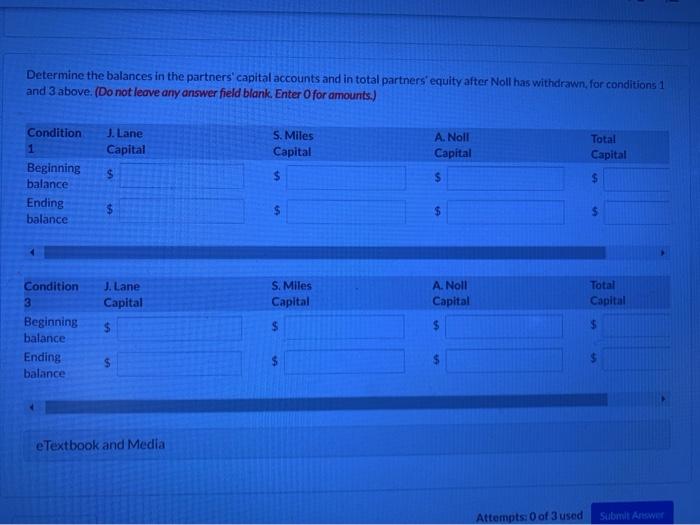

Question 6 of 7 -12 View Policies Current Attempt in Progress Julie Lane, Sara Miles, and Amber Noll have capital balances of $45,800.$36,400 and $29.100, respectively. The profit and loss ratio is 5:32. Assume Noll withdraws from the partnership on December 31 of the current year under each of the following independent conditions: 1. 2. 3. Miles agrees to purchase all of Noll's equity by paying $33,420 cash from her personal assets Noll withdraws $29.100 cash from the partnership Noll withdraws $35,980 cash from the partnership Journalize the withdrawal of Noll under each of the above assumptions. (Credit account titles are automatically dested when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation (1) Dec. 31 (To record withdrawal of a partner) (2) Dec 31 To record withdrawal of aparte uestion 6 of 7 -12 E Journalize the withdrawal of Noll under each of the above assumptions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (1) Dec 31 I I (To record withdrawal of a partner.) (2) Dec 31 (To record withdrawal of a partner.) (3) Dec. 31 (To record withdrawal of a partner) e Textbook and Media Determine the balances in the partners' capital accounts and in total partners' equity after Noll has withdrawn, for conditions 1 and 3 above. (Do not leave any answer field blank. Enter Ofor amounts.) J. Lane Capital 5. Miles Capital A. Noll Capital Total Capital Condition 1 Beginning balance Ending balance $ $ $ $ $ $ $ J. Lane Capital S. Miles Capital A. Noll Capital Total Capital $ Condition 3 Beginning balance Ending balance $ S $ $ e Textbook and Media Attempts: 0 of 3 used Sub AWET

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts