Question: Question is provided with Solution, can you help me understand I cant understand which value is used where. Please help from start Soumo has 3,00,000

Question is provided with Solution, can you help me understand

I cant understand which value is used where.

Please help from start

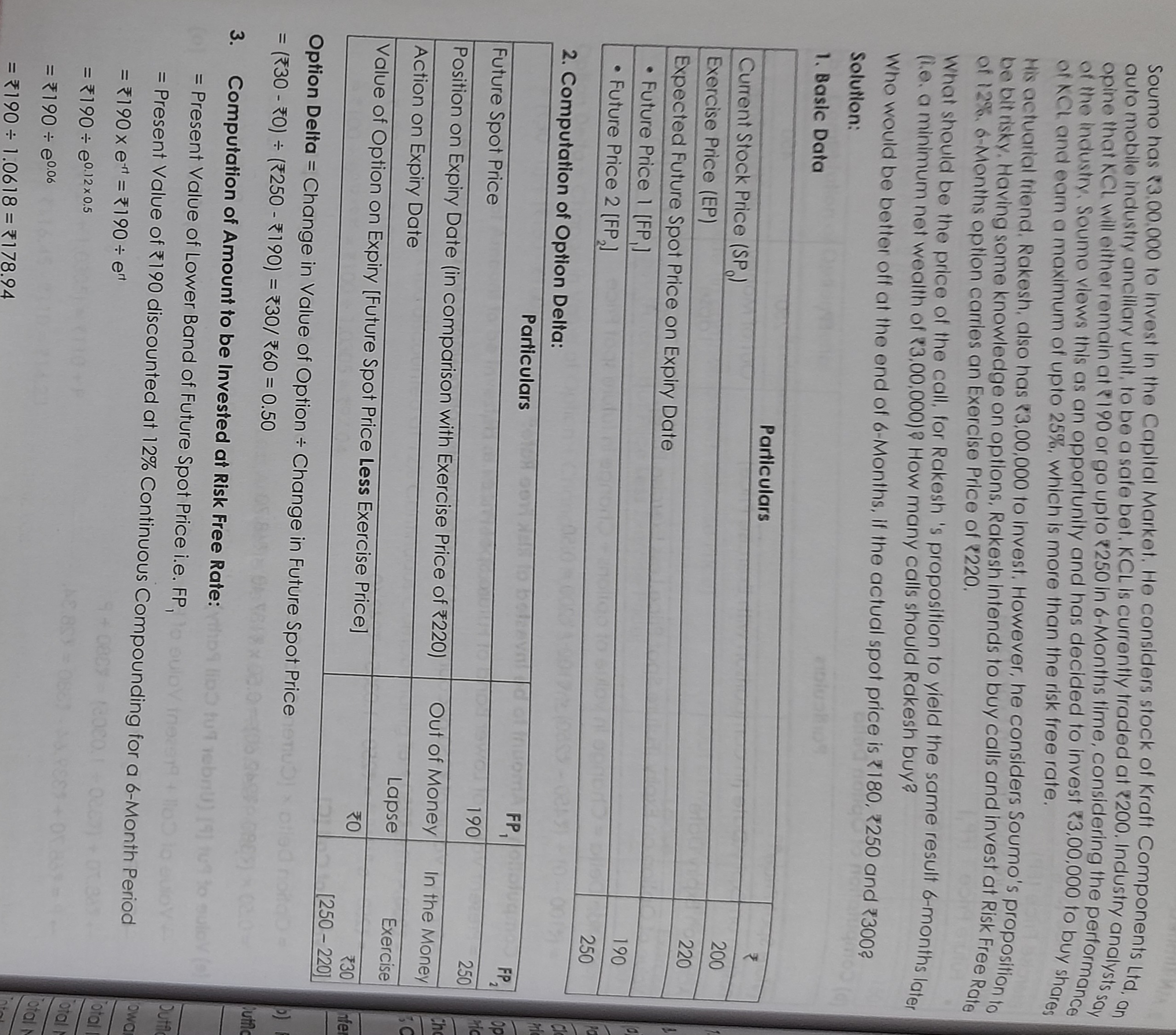

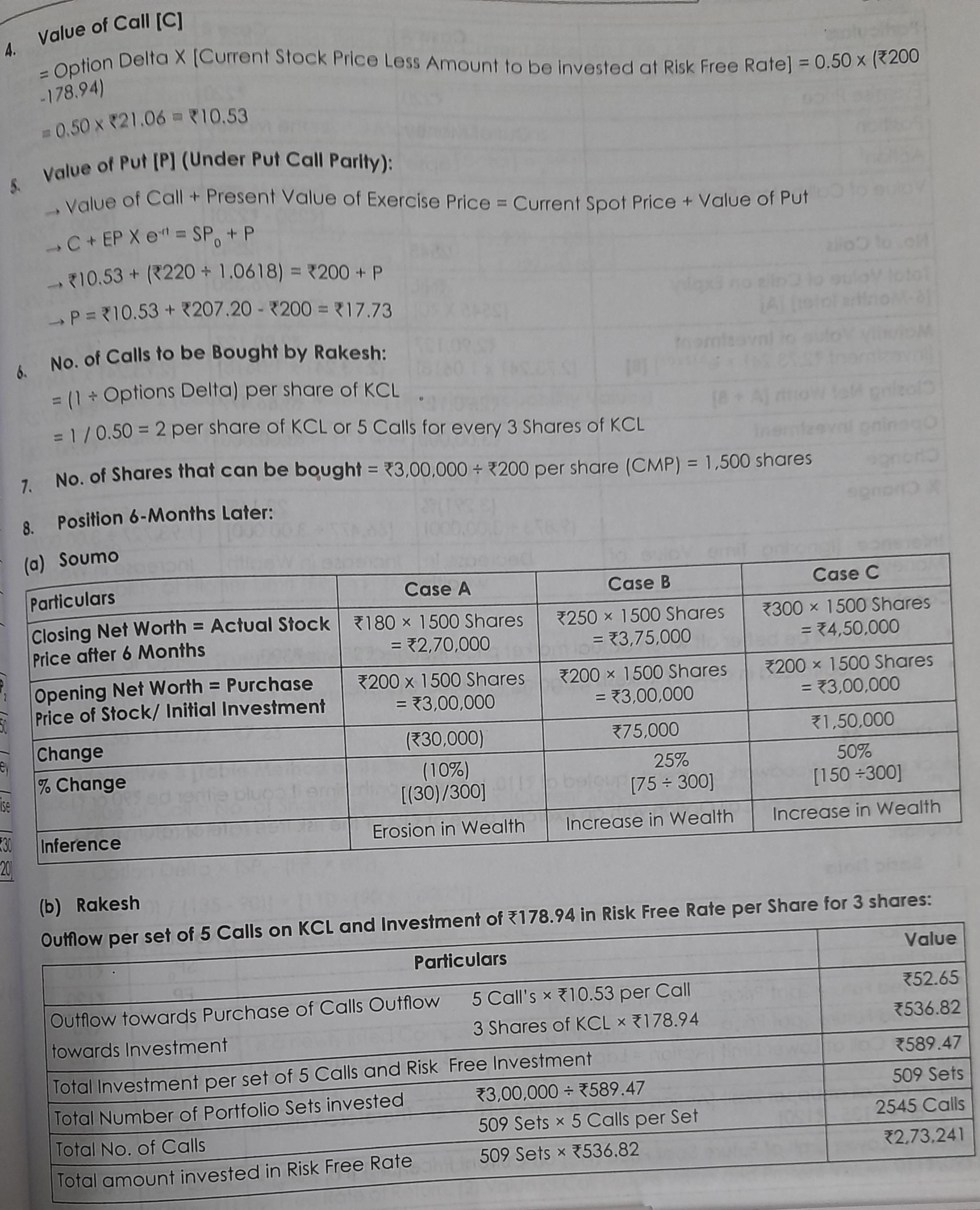

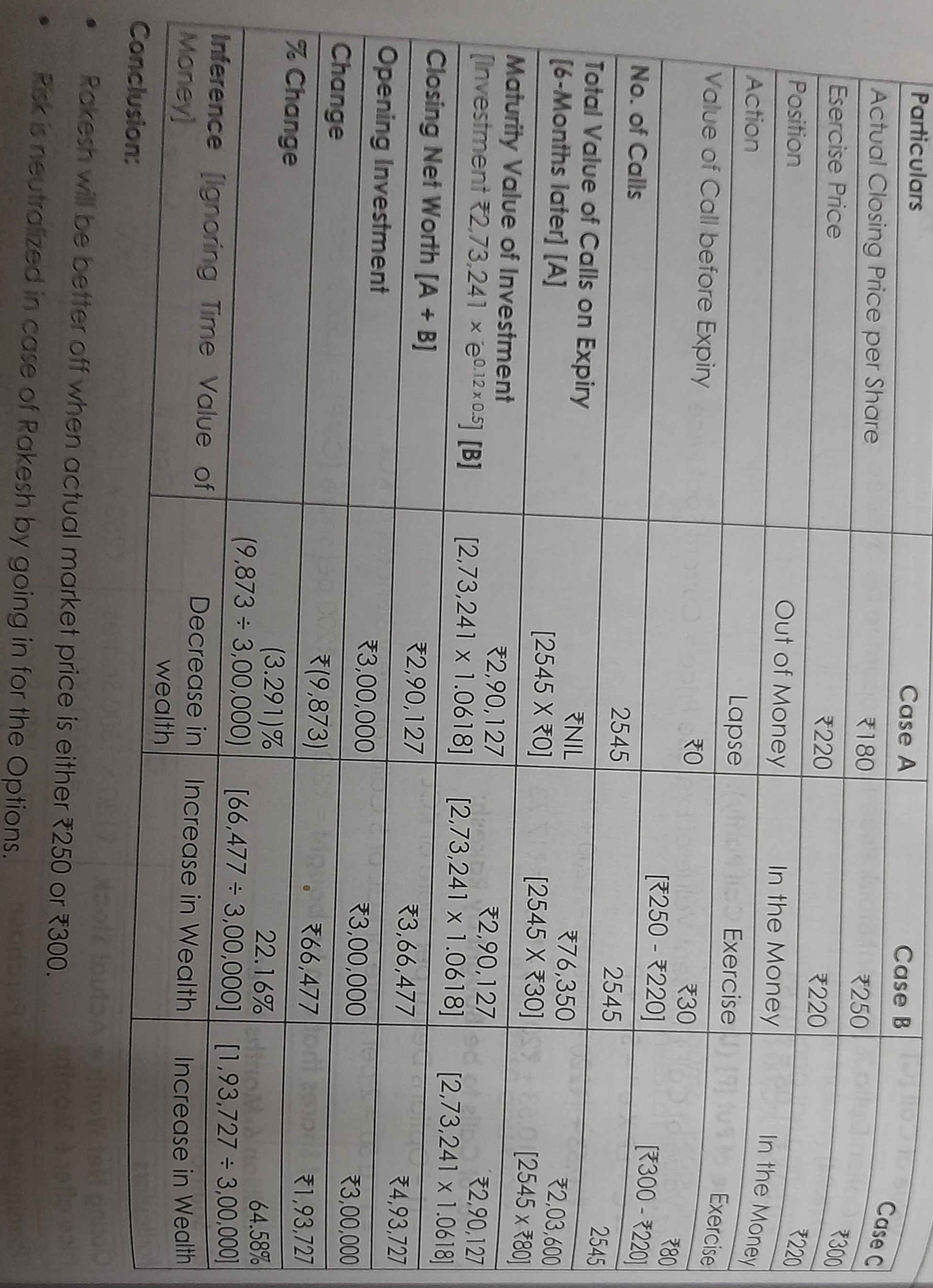

Soumo has 3,00,000 to invest in the Capllal Markel. He considers stock of Kraft Components Ltd, an auto mobile industry anelliary unil, to be a safe bel. KCL is currently traded at 200. Industry analysts say opine that KCL will either remain at 190 or go upto 250 in 6-Months time, considering the performance of the industry. Soume vlews this as an opportunity and has decided to invest 3,00,000 to buy shares of ACl and eam a maximum of uplo 25%, which is more than the risk free rate. His actuarial friend, Rakesh, also has 3,00,000 to invest. However, he considers Soumo's proposition to be bit risky. Having some knowledge on options, Rakesh intends to buy calls and invest at Risk Free Rate of 12%. 6-Menths option carries an Exercise Price of 220. What should be the price of the call, for Rakesh 's proposition to yield the same resulf 6-months later (i.e. a minimum net wealth of 3,00,000) ? How many calls should Rakesh buy? Who would be better off at the end of 6-Months, if the actual spot price is 180, 250 and 300? Solution: 1. Basic Daia U.iun verra = Change in Value of Option Change in Future Spot Price =(300)(250190)=30/60=0.50 3. Computation of Amount to be Invested at Risk Free Rate: =PresentValueofLowerBandofFutureSpotPricei.e.FP,=PresentValueof190discountedat12%ContinuousCompoundingfora6-MonthPeriod=190er=190et=190e0.120.5=190e0.06=1901.0618=178.94 4. value of Call [C] =OptionDelta[CurrentStockPriceLessAmounttobeinvestedatRiskFreeRate]=0.50[200.178.94) =0.50221.06=10.53 5. Value of Put [P] (Under Put Call Parlty): Value of Call + Present Value of Exercise Price = Current Spot Price + Value of Put C+EPXe1=SP0+P10.53+(2201.0618)=200+PP=10.53+207.20200=17.73 6. No. of Calls to be Bought by Rakesh: =(1 Options Delta) per share of KCL. =1/0.50=2 per share of KCL or 5 Calls for every 3 Shares of KCL 7. No. of Shares that can be bought =3,00,000200 per share (CMP)=1,500 shares 8. Position 6-Months Later: (b) Rakesh Rakesh will be better off when actual market price is either 250 or 300 . Pisk is neutralized in case of Rakesh by going in for the Options. Soumo has 3,00,000 to invest in the Capllal Markel. He considers stock of Kraft Components Ltd, an auto mobile industry anelliary unil, to be a safe bel. KCL is currently traded at 200. Industry analysts say opine that KCL will either remain at 190 or go upto 250 in 6-Months time, considering the performance of the industry. Soume vlews this as an opportunity and has decided to invest 3,00,000 to buy shares of ACl and eam a maximum of uplo 25%, which is more than the risk free rate. His actuarial friend, Rakesh, also has 3,00,000 to invest. However, he considers Soumo's proposition to be bit risky. Having some knowledge on options, Rakesh intends to buy calls and invest at Risk Free Rate of 12%. 6-Menths option carries an Exercise Price of 220. What should be the price of the call, for Rakesh 's proposition to yield the same resulf 6-months later (i.e. a minimum net wealth of 3,00,000) ? How many calls should Rakesh buy? Who would be better off at the end of 6-Months, if the actual spot price is 180, 250 and 300? Solution: 1. Basic Daia U.iun verra = Change in Value of Option Change in Future Spot Price =(300)(250190)=30/60=0.50 3. Computation of Amount to be Invested at Risk Free Rate: =PresentValueofLowerBandofFutureSpotPricei.e.FP,=PresentValueof190discountedat12%ContinuousCompoundingfora6-MonthPeriod=190er=190et=190e0.120.5=190e0.06=1901.0618=178.94 4. value of Call [C] =OptionDelta[CurrentStockPriceLessAmounttobeinvestedatRiskFreeRate]=0.50[200.178.94) =0.50221.06=10.53 5. Value of Put [P] (Under Put Call Parlty): Value of Call + Present Value of Exercise Price = Current Spot Price + Value of Put C+EPXe1=SP0+P10.53+(2201.0618)=200+PP=10.53+207.20200=17.73 6. No. of Calls to be Bought by Rakesh: =(1 Options Delta) per share of KCL. =1/0.50=2 per share of KCL or 5 Calls for every 3 Shares of KCL 7. No. of Shares that can be bought =3,00,000200 per share (CMP)=1,500 shares 8. Position 6-Months Later: (b) Rakesh Rakesh will be better off when actual market price is either 250 or 300 . Pisk is neutralized in case of Rakesh by going in for the Options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts