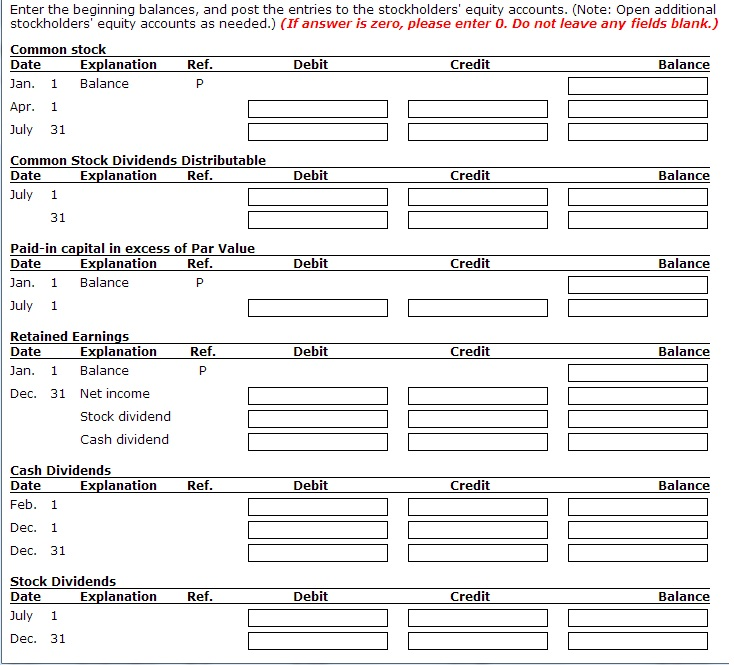

Question: Question is the second picture Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as

Question is the second picture

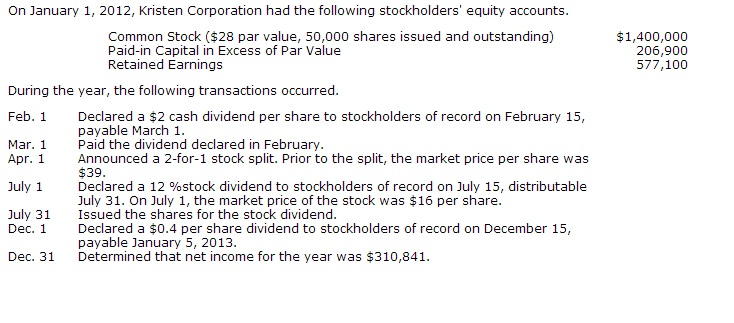

Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) (If answer is zero, please enter 0. Do not leave any fields blank.) On January 1, 2012, Kristen Corporation had the following stockholders' equity accounts. During the year, the following transactions occurred. Declared a $2 cash dividend per share to stockholders of record on February 15, payable March 1. Paid the dividend declared in February. Announced a 2-for-1 stock split. Prior to the split, the market price per share was $39. Declared a 12 %stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $16 per share. Issued the shares for the stock dividend. Declared a $0.4 per share dividend to stockholders of record on December 15, payable January 5, 2013. Determined that net income for the year was $310,841

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts