Question: Question itself above Template for the question above QUESTION 5 (25 points) The following table shows the parameters of a Black-Sholes option pricing model. Black-Scholes

Question itself above

Question itself above

Template for the question above

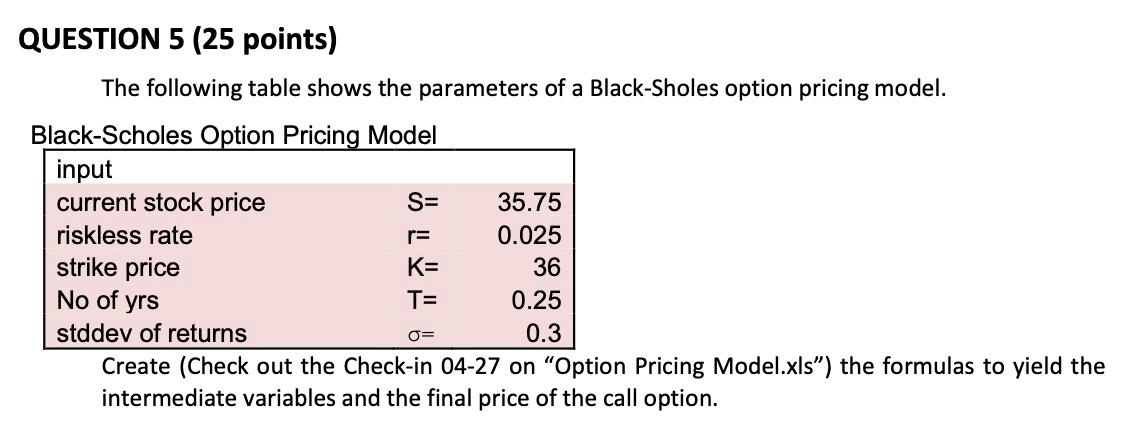

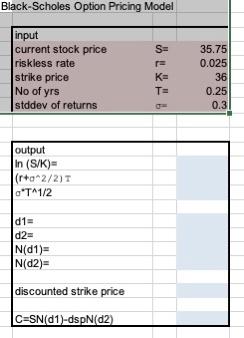

QUESTION 5 (25 points) The following table shows the parameters of a Black-Sholes option pricing model. Black-Scholes Option Pricing Model input current stock price S= 35.75 riskless rate r= 0.025 strike price K= 36 No of yrs T= 0.25 stddev of returns 0.3 Create (Check out the Check-in 04-27 on "Option Pricing Model.xls") the formulas to yield the intermediate variables and the final price of the call option. O= Black-Scholes Option Pricing Model input current stock price riskless rate strike price No of yrs stddev of returns K T= 35.75 0.025 36 0.25 0.3 output In (S/K)- (r+a+2/2) O'T^1/2 d1= d2- N(1) N(02) discounted strike price C=SN(d1)-dspN(D2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts