Question: Question IV. (8 Marks) Fizzle Corp. will pay a dividend of $5 per share at the end of next year (end of year 1) and

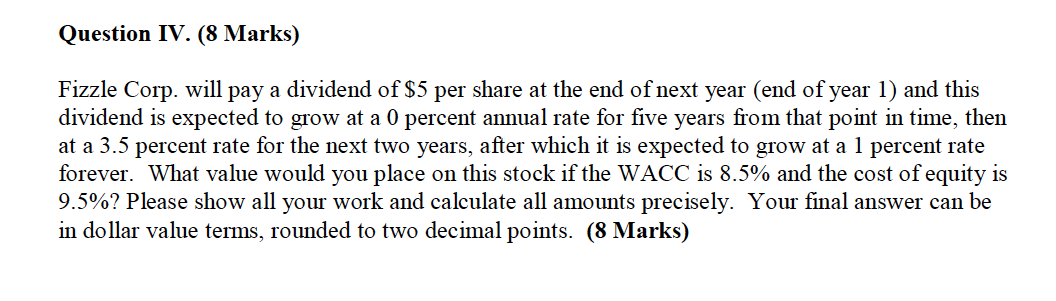

Question IV. (8 Marks) Fizzle Corp. will pay a dividend of $5 per share at the end of next year (end of year 1) and this dividend is expected to grow at a 0 percent annual rate for five years from that point in time, then at a 3.5 percent rate for the next two years, after which it is expected to grow at a 1 percent rate forever. What value would you place on this stock if the WACC is 8.5% and the cost of equity is 9.5%? Please show all your work and calculate all amounts precisely. Your final answer can be in dollar value terms, rounded to two decimal points. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock