Question: Question IV Bear Spread Using Puts (10 points) Suppose that put options on a stock with strike prices $30 and $35 cost $4 and $7,

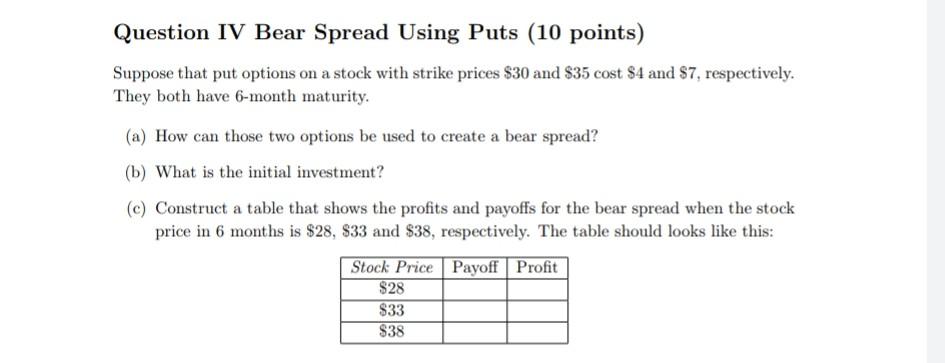

Question IV Bear Spread Using Puts (10 points) Suppose that put options on a stock with strike prices $30 and $35 cost $4 and $7, respectively. They both have 6-month maturity. (a) How can those two options be used to create a bear spread? (b) What is the initial investment? (c) Construct a table that shows the profits and payoffs for the bear spread when the stock price in 6 months is $28, $33 and $38, respectively. The table should looks like this: Payoff Profit Stock Price $28 $33 $38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts