Question: Question- List and discuss Swap contract method that employed by Toyota company to manage their foreign currency transaction exposures.( 300 words ) Note - please

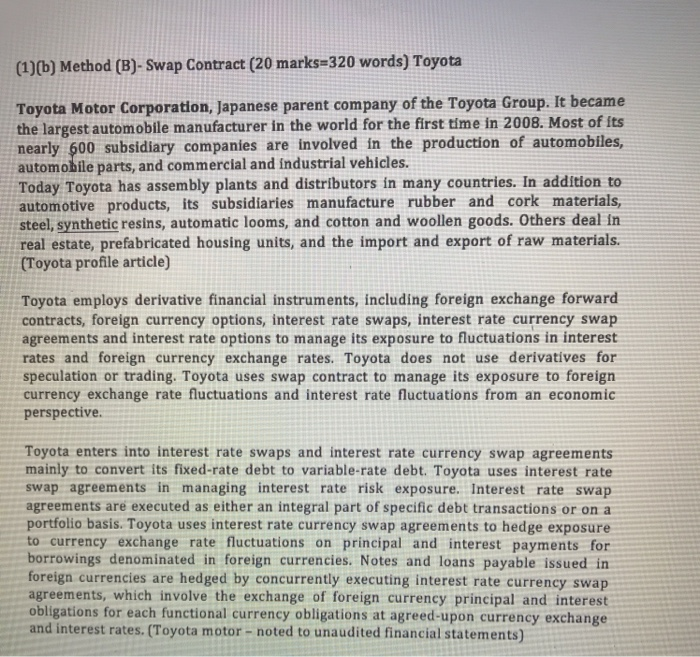

(1)(b) Method (B)- Swap Contract (20 marks 320 words) Toyota Toyota Motor Corporation, Japanese parent company of the Toyota Group. It became the largest automobile manufacturer in the world for the first time in 2008. Most of its nearly 600 subsidiary companies are involved in the production of automobiles automobile parts, and commercial and industrial vehicles. Today Toyota has assembly plants and distributors in many countries. In addition to automotive products, its subsidiaries manufacture rubber and cork materials, steel, synthetic resins, automatic looms, and cotton and woollen goods. Others deal in real estate, prefabricated housing units, and the import and export of raw materials. (Toyota profile article) Toyota employs derivative financial instruments, including foreign exchange forward contracts, foreign currency options, interest rate swaps, interest rate currency swap agreements and interest rate options to manage its exposure to fluctuations in interest rates and foreign currency exchange rates. Toyota does not use derivatives for speculation or trading. Toyota uses swap contract to manage its exposure to foreign currency exchange rate fluctuations and interest rate fluctuations from an economic perspective Toyota enters into interest rate swaps and interest rate currency swap agreements mainly to convert its fixed-rate debt to variable-rate debt. Toyota uses interest rate swap agreements in managing interest rate risk exposure. Interest rate swap agreements are executed as either an integral part of specific debt transactions or on a portfolio basis. Toyota uses interest rate currency swap agreements to hedge exposure to currency exchange rate fluctuations on principal and interest payments for borrowings denominated in foreign currencies. Notes and loans payable issued in foreign currencies are hedged by concurrently executing interest rate currency swap agreements, which involve the exchange of foreign currency principal and interest obligations for each functional currency obligations at agreed-upon currency exchange and interest rates. (Toyota motor- noted to unaudited financial statements)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts