Question: Question list Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 in San Francisco in which it has estimated the following expected

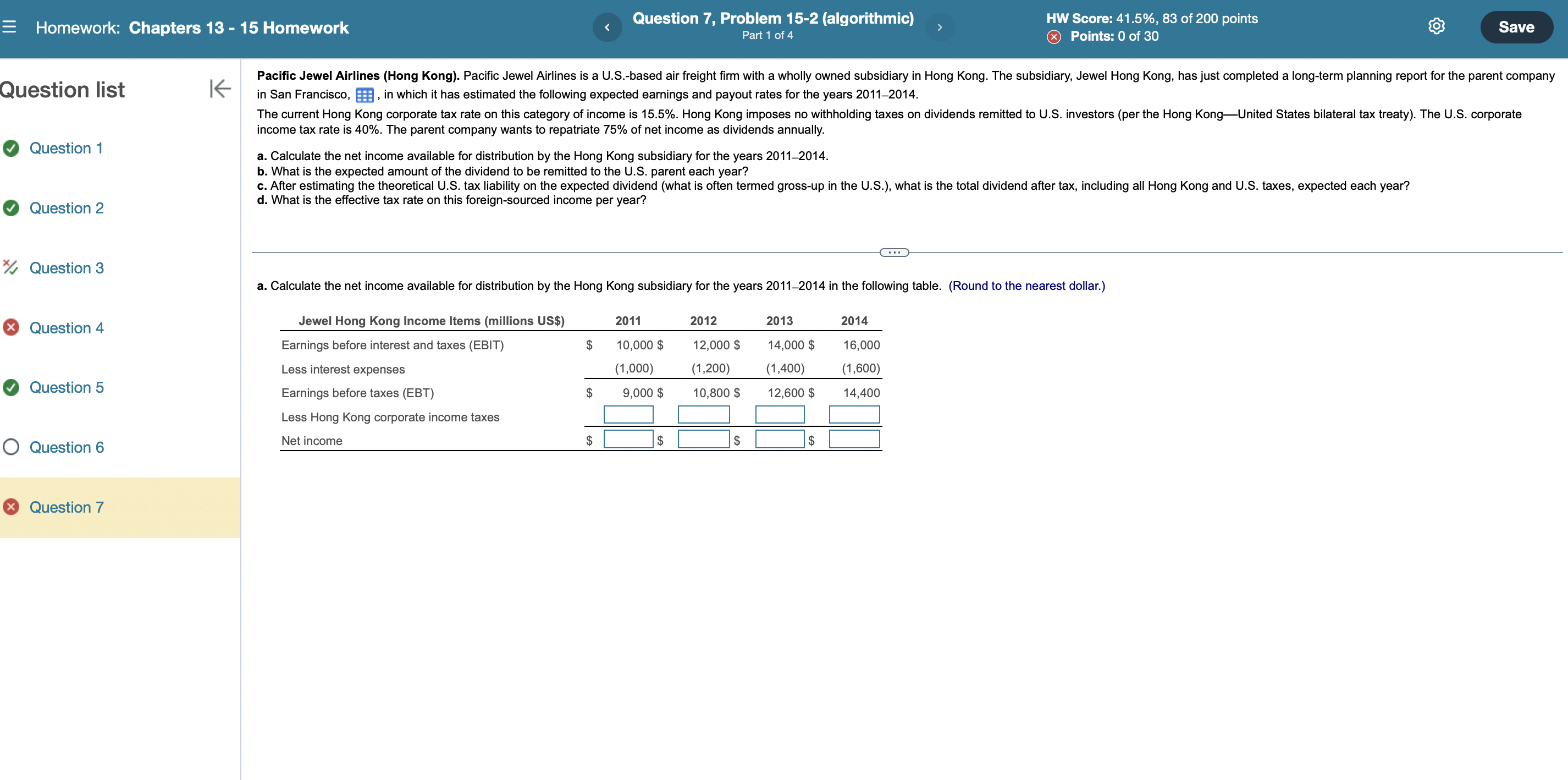

Question list Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 in San Francisco in which it has estimated the following expected earnings and payout rates for the years 2011-2014. income tax rate is 40%. The parent company wants to repatriate 75% of net income as dividends annually. a. Calculate the net income available for distribution by the Hong Kong subsidiary for the years 2011-2014. b. What is the expected amount of the dividend to be remitted to the U.S. parent each year? d. What is the effective tax rate on this foreign-sourced income per year? a. Calculate the net income available for distribution by the Hong Kong subsidiary for the years 2011-2014 in the following table. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts