Question: Question ( MACRS and After Tax Salvage ) : The Staple Supply Co . has just purchased a new computerized information system with an installed

Question MACRS and After Tax Salvage:

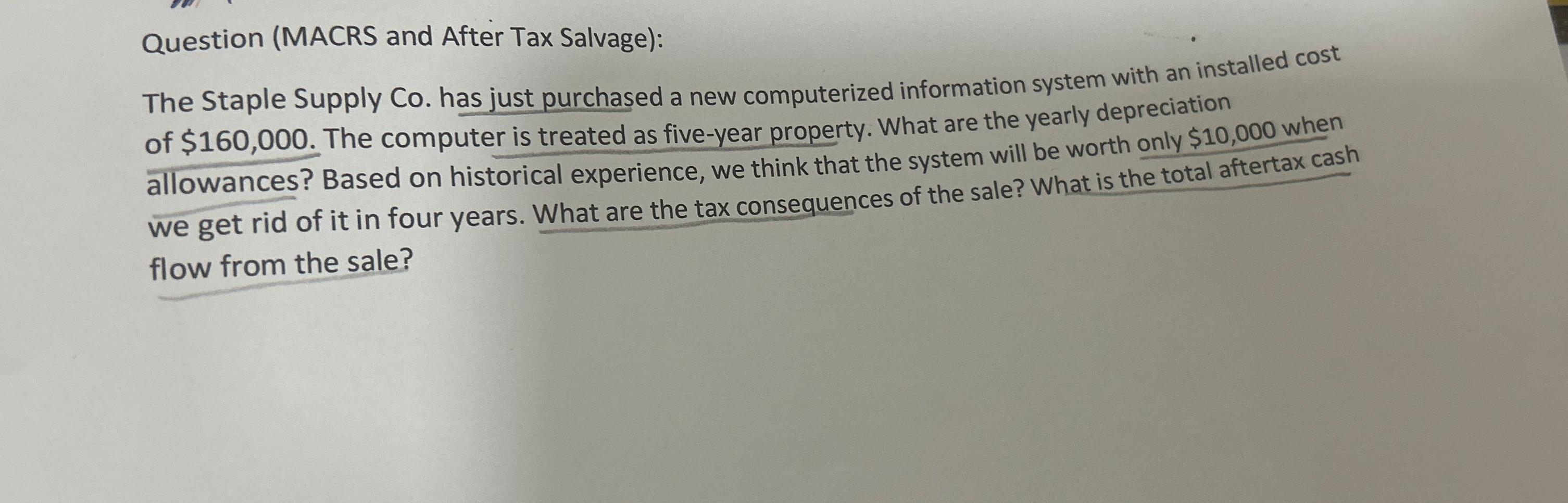

The Staple Supply Co has just purchased a new computerized information system with an installed cost of $ The computer is treated as fiveyear property. What are the yearly depreciation allowances? Based on historical experience, we think that the system will be worth only $ when we get rid of it in four years. What are the tax consequences of the sale? What is the total aftertax cash flow from the sale?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock