Question: Question: Measuring and reporting the nation's finances are based on government budgeting, national accounting and the accounting discipline, which are all fundamentally different. The nature

Question:

Measuring and reporting the nation's finances are based on government budgeting, national accounting and the accounting discipline, which are all fundamentally different. The nature and extent of these differences has rarely been made explicit. The most visible change in the accounting discipline in the second half of the 20th century was the emergence of codifications of accounting, with concomitant policy-making processes that allow for 'due process'. One result is that each codification is different within countries such as the UK and US, as well as between them. The codifications for government budgeting and national accounting are different again. The article offers some broad conclusions.

additional questions

Q1. Define Fair Value?

Q2. What Is Meant By Take Over?

Q3. What Is Secondary Market?

Q4. What Is Call Option?

Q5. What Is Raroc?

Q6. What Is The Internal Rate Of Return(irr) Of Eurekaforbes?

Q7. What Is Eps?

Q8. What Is Hedging?

Q9. What Is The Punch Line Of Job?

Q10. What Is The Entry For Deprecation?

Solve

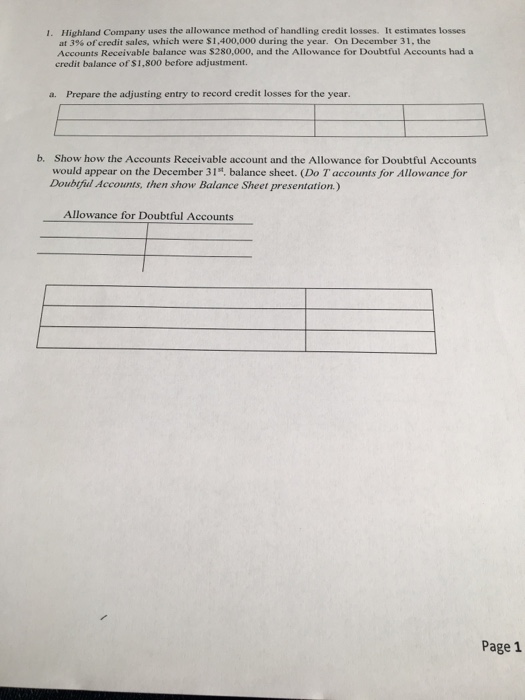

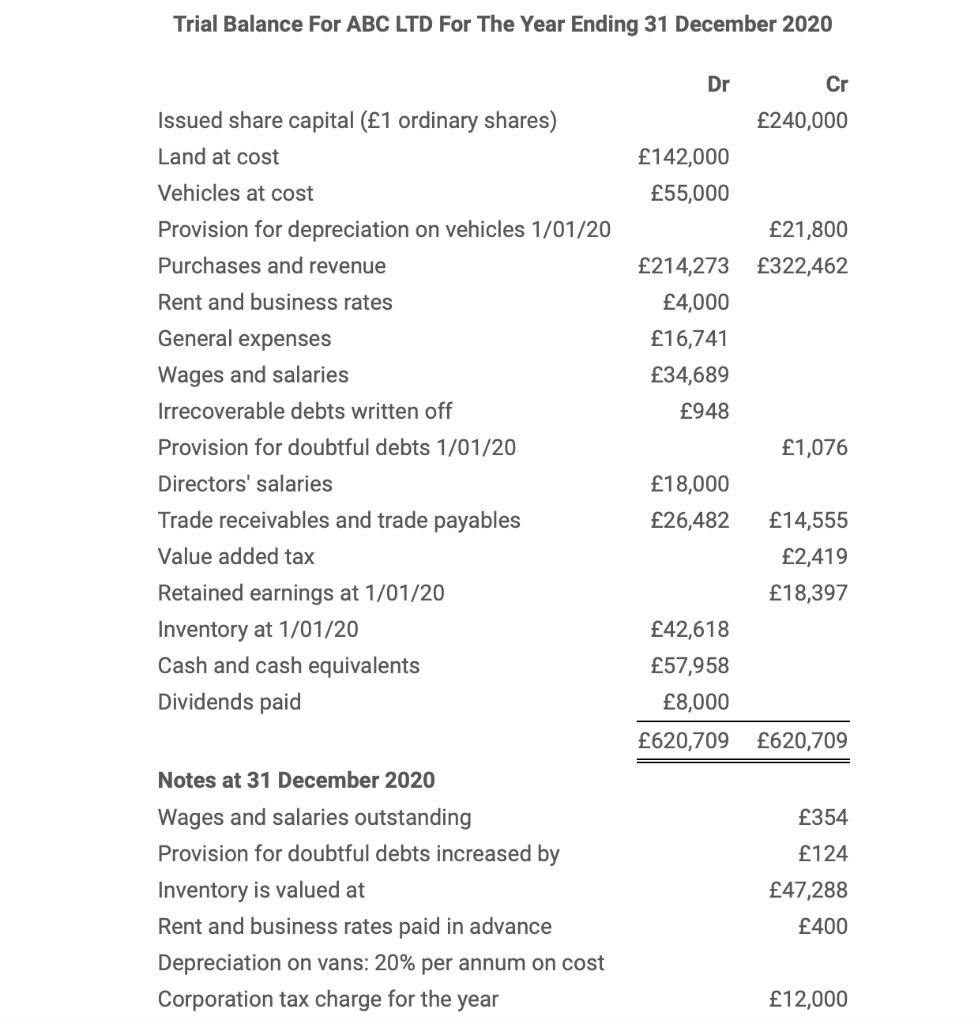

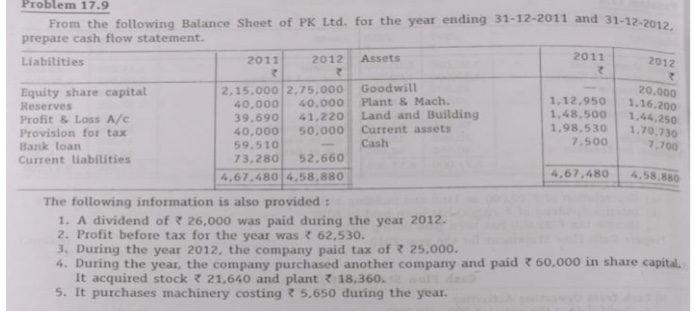

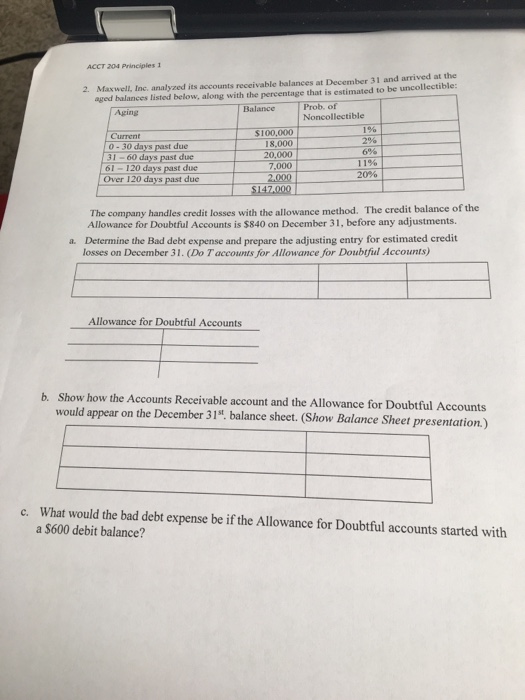

I. Highland Company uses the allowance method of handling credit losses. It estimates losses at 39% of credit sales, which were $1,400,000 during the year. On December 31, the Accounts Receivable balance was $280,000, and the Allowance for Doubtful Accounts had a credit balance of $1,800 before adjustment. n. Prepare the adjusting entry to record credit losses for the year. b. Show how the Accounts Receivable account and the Allowance for Doubtful Accounts would appear on the December 31", balance sheet. (Do T accounts for Allowance for Doubtful Accounts, then show Balance Sheet presentation.) Allowance for Doubtful Accounts Page 1Trial Balance For ABC LTD For The Year Ending 31 December 2020 Dr Cr Issued share capital (1 ordinary shares) 240,000 Land at cost 142,000 Vehicles at cost 55,000 Provision for depreciation on vehicles 1/01/20 21,800 Purchases and revenue 214,273 322,462 Rent and business rates 4,000 General expenses 16,741 Wages and salaries 34,689 Irrecoverable debts written off 948 Provision for doubtful debts 1101120 1,076 Directors' salaries 18,000 Trade receivables and trade payables 26,482 14,555 Value added tax 2,419 Retained earnings at 1701720 18,397 Inventory at 1/01/20 42,618 Cash and cash equivalents 57,958 Dividends paid 8,000 620,709 620,709 Notes at 31 December 2020 Wages and salaries outstanding 354 Provision for doubtful debts increased by 124 Inventory is valued at 47,288 Rent and business rates paid in advance 400 Depreciation on vans: 20% per annum on cost Corporation tax charge for the year 12,000 Problem 17.9 From the following Balance Sheet of PK Ltd. for the year ending 31-12-2011 and 31-12-2012 prepare cash flow statement. Liabilities 2011 2012 Assets 2011 2012 Equity share capital 2,15,000 2.75.000 Good will 20.000 Reserves 40.000 40,000 Plant & Mach. 1, 12,950 1,16.200 Profit & Loss A/C 39.690 41,220 Land and Building 1.48.500 1,44,250 Provision for tax 40.000 50,000 Current assets 1,98,530 1,70.730 Bank loan 59.510 Cash 7.500 7.700 Current liabilities 73.280 52.660 4,67,480 4.58,880 4,67.480 4. 58.880 The following information is also provided : 1. A dividend of