Question: Question No. 01: Marks: 10) a) Mr. X has been considering investing in the bonds of Beximco Ltd. The bonds were issued 5 years ago

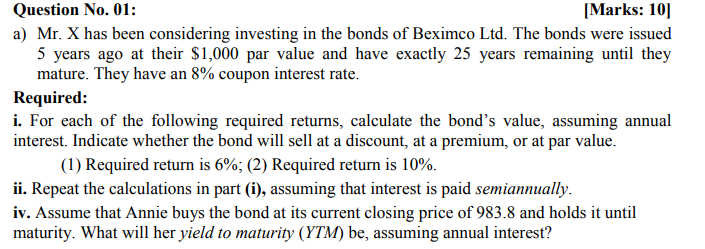

Question No. 01: Marks: 10) a) Mr. X has been considering investing in the bonds of Beximco Ltd. The bonds were issued 5 years ago at their $1,000 par value and have exactly 25 years remaining until they mature. They have an 8% coupon interest rate. Required: i. For each of the following required returns, calculate the bond's value, assuming annual interest. Indicate whether the bond will sell at a discount, at a premium, or at par value. (1) Required return is 6%; (2) Required return is 10%. ii. Repeat the calculations in part (i), assuming that interest is paid semiannually. iv. Assume that Annie buys the bond at its current closing price of 983.8 and holds it until maturity. What will her yield to maturity (YTM) be, assuming annual interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts