Question: Question No: 02 SCHE 05 This is a subjective question, hence you have to write your answer in the Text-Field given below A Venture Capital

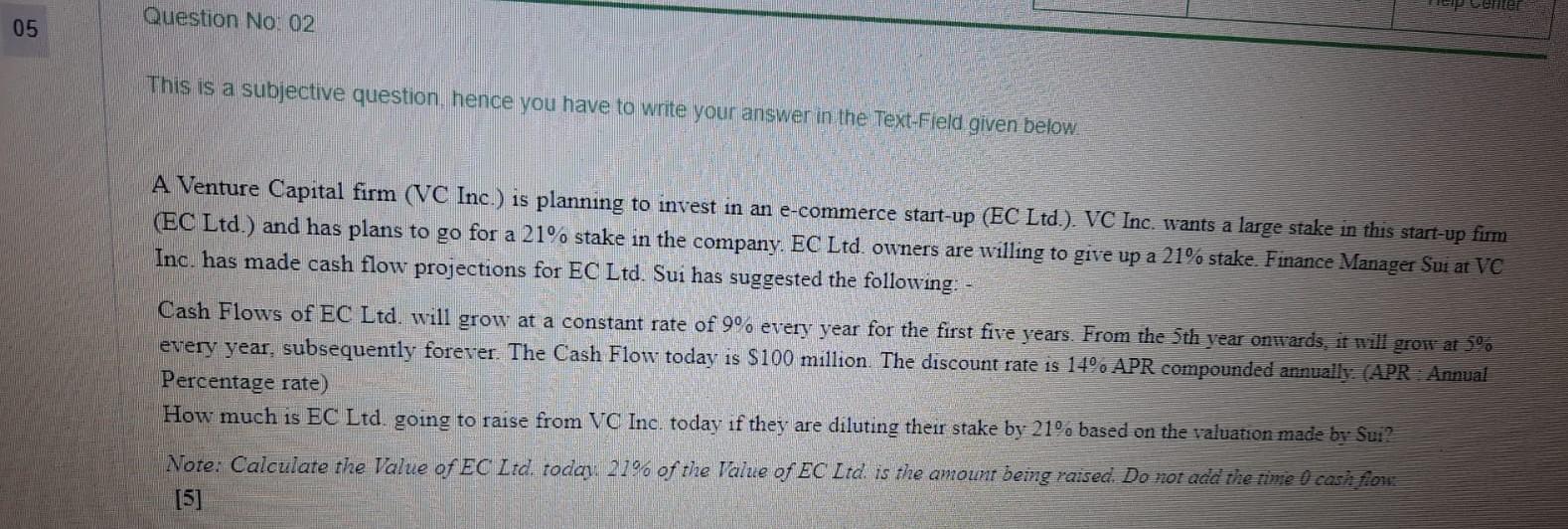

Question No: 02 SCHE 05 This is a subjective question, hence you have to write your answer in the Text-Field given below A Venture Capital firm (VC Inc.) is planning to invest in an e-commerce start-up (EC Ltd.). VC Inc. wants a large stake in this start-up fum (EC Ltd.) and has plans to go for a 21% stake in the company. EC Ltd. owners are willing to give up a 21% stake. Finance Manager Sui at VC Inc. has made cash flow projections for EC Ltd. Sui has suggested the following: Cash Flows of EC Ltd. will grow at a constant rate of 9 every year for the first five years. From the 5th year onwards, it will grow at 5 every year, subsequently forever. The Cash Flow today is $100 million. The discount rate is 14. APR compounded annually: (APR : Annual Percentage rate) How much is EC Ltd. going to raise from VC Inc. today if they are diluting their stake by 21 based on the valuation made by Sui? Note: Calculate the value of EC Lid today. 21% of the value of EC Ltd. is the amount being raised. Do not add the time 0 cash fione [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts