Question: Question No 03 This is a subjective question, hence you have to write your answer in the Text-Field given below. Project A nas an initial

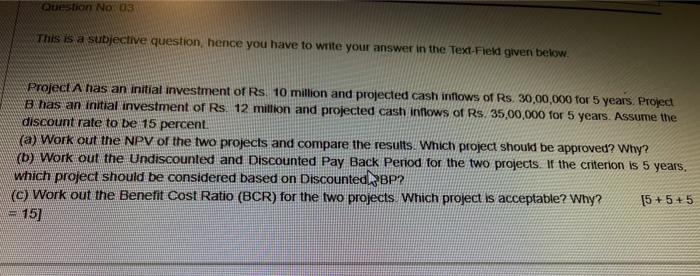

Question No 03 This is a subjective question, hence you have to write your answer in the Text-Field given below. Project A nas an initial investment of Rs. 10 million and projected cash inflows of Rs. 30,00,000 for 5 years. Project B has an initial investment of Rs. 12 million and projected cash inflows of Rs. 35,00,000 for 5 years. Assume the discount rate to be 15 percent. (a) Work out the NPV of the two projects and compare the results. Which project should be approved? Why? (b) Work out the Undiscounted and Discounted Pay Back Period for the two projects. It the criterion is 5 years. which project should be considered based on Discounted BP2 (C) Work out the Benefit Cost Ratio (BCR) for the two projects Which project is acceptable? Why? [5+5+5 15]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts