Question: Question No: 08 This is a subjective question, hence you have to write your answer in the Text-Field given below. S Ltd. is considering purchase

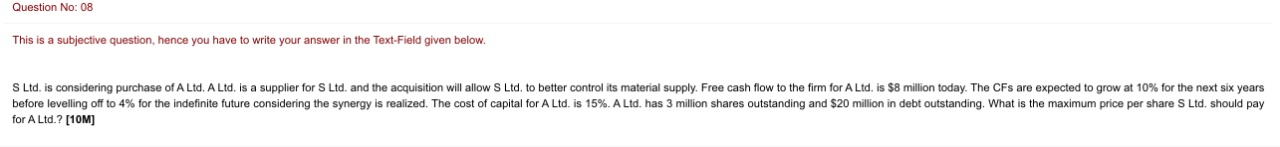

Question No: 08 This is a subjective question, hence you have to write your answer in the Text-Field given below. S Ltd. is considering purchase of A Ltd. A Ltd. is a supplier for S Ltd. and the acquisition will allow S Ltd. to better control its material supply. Free cash flow the firm for A Ltd. is $8 million today. The CFs are expected to grow 10% for the next six years before levelling off to 4% for the indefinite future considering the synergy is realized. The cost of capital for A Ltd. is 15%. A Ltd. has 3 million shares outstanding and $20 million in debt outstanding. What is the maximum price per share S Ltd. should pay for A Ltd.? [10M)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts