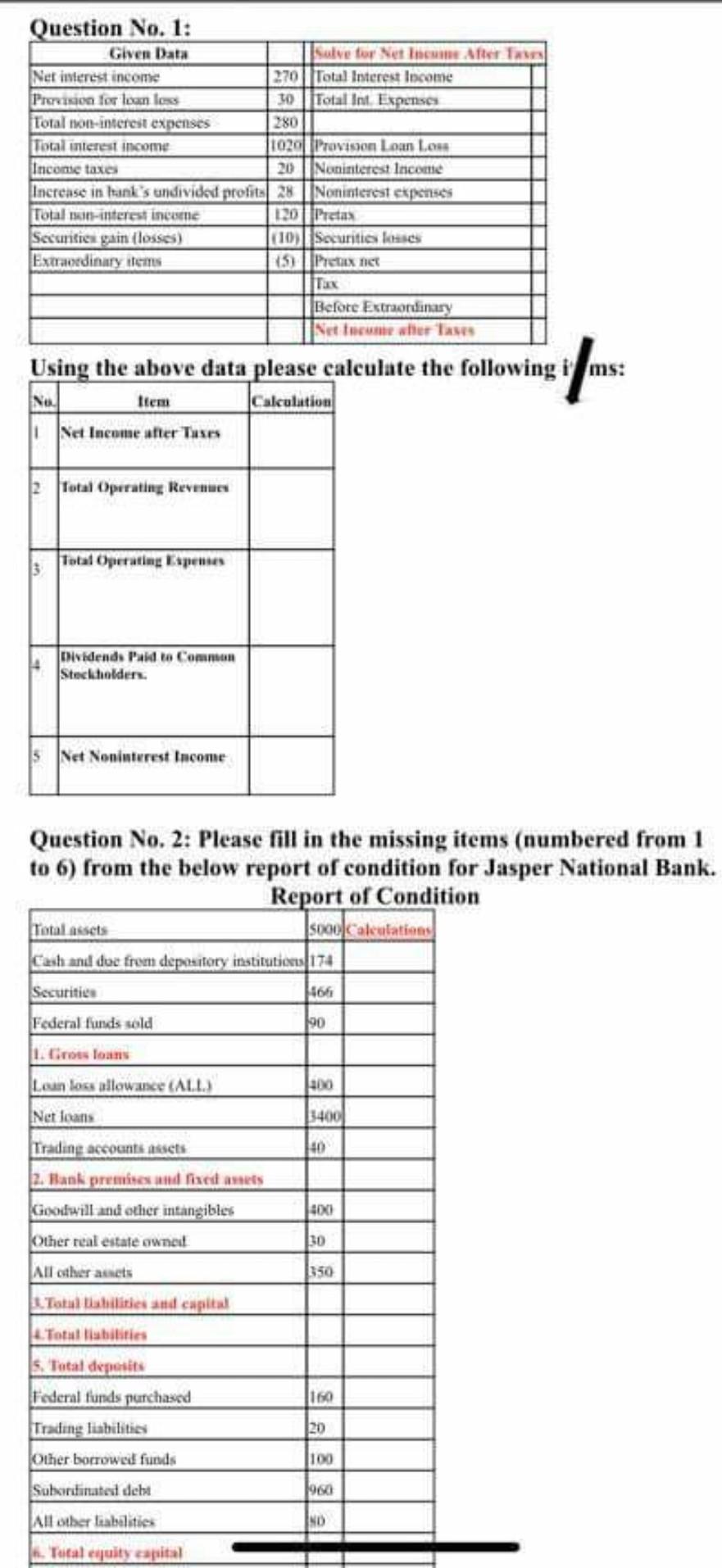

Question: Question No. 1: Given Data Salve for Net Income After Net interest income 270 | Total Interest Income Precision for loan los 30 Total Int

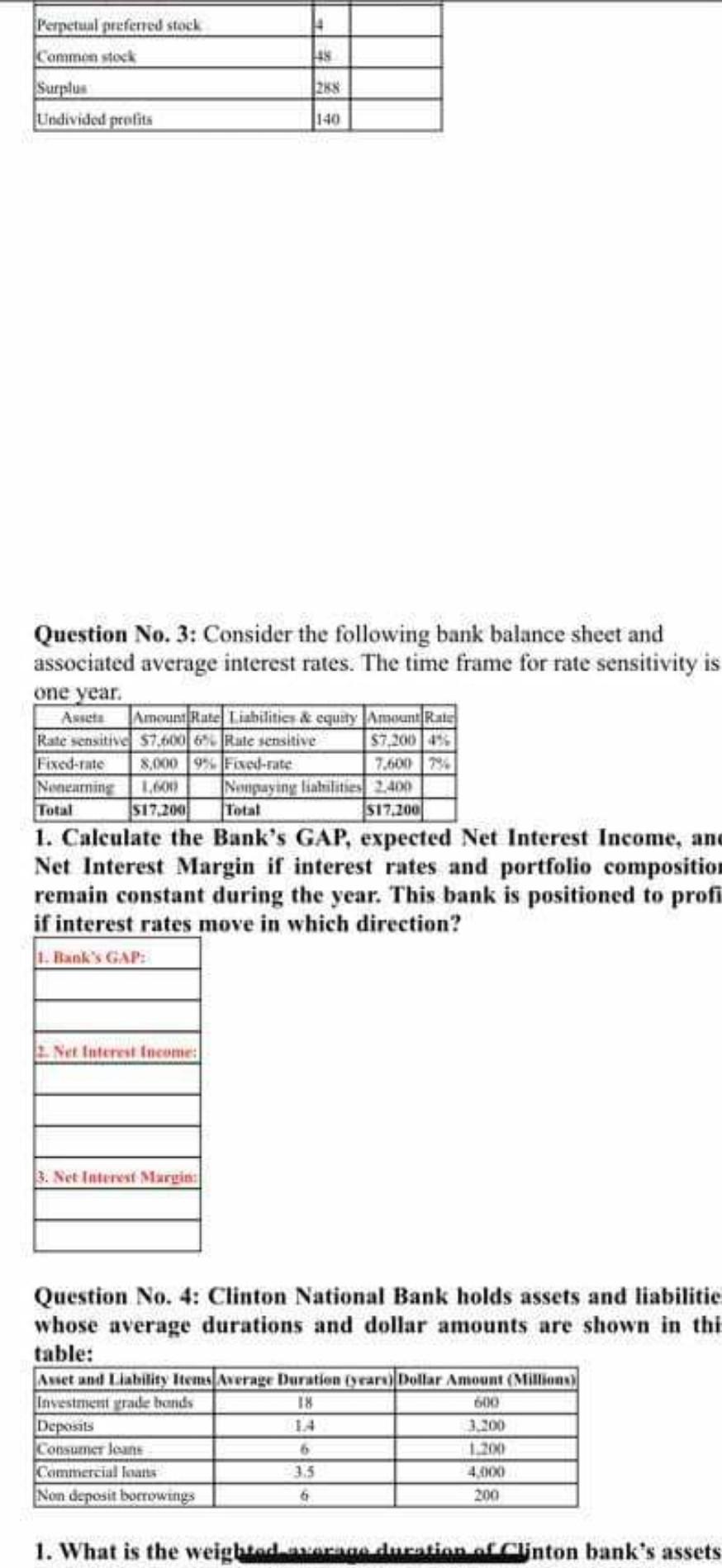

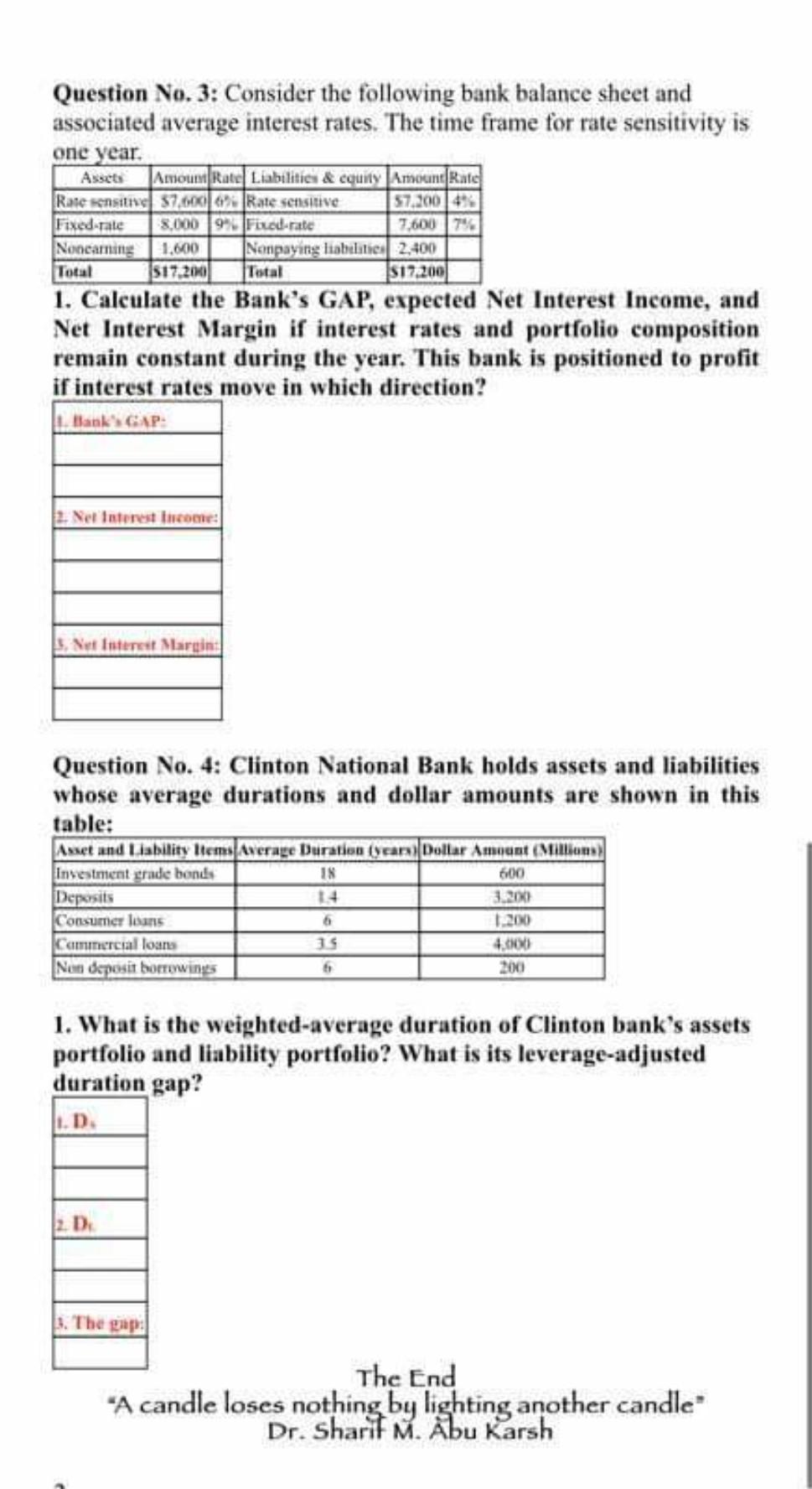

Question No. 1: Given Data Salve for Net Income After Net interest income 270 | Total Interest Income Precision for loan los 30 Total Int Expenses Total non-interest expenses 280 Total interest income 1020 Provisjon Loan Loss Income taxes 20 Noninterest Income Increase in lank's undivided profita 28 INoninterest expenses Total interest income 120 Pretas Securities gain (losses) (10) Securities losses Extraordinary tems *5Pre net Before Extraordinary Net toeume wie Tases Using the above data please calculate the following ims: Item Calculation Net Income after Tuses Total Operating Revenues Total Operating Wapentes Dividends Paid to Common Stockholders. 5 Net Noninterest Income Question No. 2: Please fill in the missing items (numbered from 1 to 6) from the below report of condition for Jasper National Bank. Report of Condition Total assets scooCalestations Cash and doc from depository institutions 174 Securities Federal funds sold 465 190 100 34001 40 401 30 1350 Lean los allowance (ALL) Net Ioana Trading accounts assets 2. Banki premises and fixet amets Goodwill and other intangibles Other real estate ownet All other anets Total abilities and capital 1. Totat liabilities s Total departits Federal funds purchased Trading liabilities Other borrowed funds Subates debt All other liabilities ... Total uity capital 160 20 100 1980 IND 14 118 Perpetual preferred stock Common stock Surplus Undivided poolita 1264 140 Question No. 3: Consider the following bank balance sheet and associated average interest rates. The time frame for rate sensitivity is one year. Assets Amour Rute Liabilities & equity AmountRate Rate sensitid 59.000 6 Rate sensitive $7.20045 Fixed-rate 8.00093 Fixed-rate 7,600791 Nenearning 1.6 Nonpaying liabilities 2400 Total $17.200 Total $17.2001 1. Calculate the Bank's GAP, expected Net Interest Income, an Net Interest Margin if interest rates and portfolio composition remain constant during the year. This bank is positioned to profi if interest rates move in which direction? 1. Bank's GAP: 2. Net Interest Income 3. Net Interest Murgin Question No. 4: Clinton National Bank holds assets and liabilitie whose average durations and dollar amounts are shown in thi table: Anet und Liability Items Average Duration years Dollar Amount (Million, Investment grade bar 18 Deposits Consumer les Commercial laats Non deposit borrowings 600 3.300 1.200 4.000 200 3.5 6 1. What is the weighted average duration of Clinton bank's assets Assets Question No. 3: Consider the following bank balance sheet and associated average interest rates. The time frame for rate sensitivity is one year. Amoun Rate Liabilities & cquity Amount Kafe Rate sensitive 37.60% Rate sensitive Fixed rate 8.000 92 Fixed rate 7.600 7% Noocanning 1.600 Nonpaying lisbilstic: 2,400 517,200 17,200 1. Calculate the Bank's GAP, expected Net Interest Income, and Net Interest Margin if interest rates and portfolio composition remain constant during the year. This bank is positioned to profit if interest rates move in which direction? Total 2. Net Interest Income Not Interest Margin Question No. 4: Clinton National Bank holds assets and liabilities whose average durations and dollar amounts are shown in this table: Asset and Liability Items Average Duration (Sara Dollar Amount (Millioms Investment grade bonds Deposits 3.2003 Consumer loans 1.200 Commercial loans 4.000 Non deposit bort wings 18 600 6 200 1. What is the weighted average duration of Clinton bank's assets portfolio and liability portfolio? What is its leverage-adjusted duration gap? LD. 2. D. s. The gap: The End "A candle loses nothing by lighting another candle Dr. Sharif M. Abu Karsh Question No. 1: Given Data Salve for Net Income After Net interest income 270 | Total Interest Income Precision for loan los 30 Total Int Expenses Total non-interest expenses 280 Total interest income 1020 Provisjon Loan Loss Income taxes 20 Noninterest Income Increase in lank's undivided profita 28 INoninterest expenses Total interest income 120 Pretas Securities gain (losses) (10) Securities losses Extraordinary tems *5Pre net Before Extraordinary Net toeume wie Tases Using the above data please calculate the following ims: Item Calculation Net Income after Tuses Total Operating Revenues Total Operating Wapentes Dividends Paid to Common Stockholders. 5 Net Noninterest Income Question No. 2: Please fill in the missing items (numbered from 1 to 6) from the below report of condition for Jasper National Bank. Report of Condition Total assets scooCalestations Cash and doc from depository institutions 174 Securities Federal funds sold 465 190 100 34001 40 401 30 1350 Lean los allowance (ALL) Net Ioana Trading accounts assets 2. Banki premises and fixet amets Goodwill and other intangibles Other real estate ownet All other anets Total abilities and capital 1. Totat liabilities s Total departits Federal funds purchased Trading liabilities Other borrowed funds Subates debt All other liabilities ... Total uity capital 160 20 100 1980 IND 14 118 Perpetual preferred stock Common stock Surplus Undivided poolita 1264 140 Question No. 3: Consider the following bank balance sheet and associated average interest rates. The time frame for rate sensitivity is one year. Assets Amour Rute Liabilities & equity AmountRate Rate sensitid 59.000 6 Rate sensitive $7.20045 Fixed-rate 8.00093 Fixed-rate 7,600791 Nenearning 1.6 Nonpaying liabilities 2400 Total $17.200 Total $17.2001 1. Calculate the Bank's GAP, expected Net Interest Income, an Net Interest Margin if interest rates and portfolio composition remain constant during the year. This bank is positioned to profi if interest rates move in which direction? 1. Bank's GAP: 2. Net Interest Income 3. Net Interest Murgin Question No. 4: Clinton National Bank holds assets and liabilitie whose average durations and dollar amounts are shown in thi table: Anet und Liability Items Average Duration years Dollar Amount (Million, Investment grade bar 18 Deposits Consumer les Commercial laats Non deposit borrowings 600 3.300 1.200 4.000 200 3.5 6 1. What is the weighted average duration of Clinton bank's assets Assets Question No. 3: Consider the following bank balance sheet and associated average interest rates. The time frame for rate sensitivity is one year. Amoun Rate Liabilities & cquity Amount Kafe Rate sensitive 37.60% Rate sensitive Fixed rate 8.000 92 Fixed rate 7.600 7% Noocanning 1.600 Nonpaying lisbilstic: 2,400 517,200 17,200 1. Calculate the Bank's GAP, expected Net Interest Income, and Net Interest Margin if interest rates and portfolio composition remain constant during the year. This bank is positioned to profit if interest rates move in which direction? Total 2. Net Interest Income Not Interest Margin Question No. 4: Clinton National Bank holds assets and liabilities whose average durations and dollar amounts are shown in this table: Asset and Liability Items Average Duration (Sara Dollar Amount (Millioms Investment grade bonds Deposits 3.2003 Consumer loans 1.200 Commercial loans 4.000 Non deposit bort wings 18 600 6 200 1. What is the weighted average duration of Clinton bank's assets portfolio and liability portfolio? What is its leverage-adjusted duration gap? LD. 2. D. s. The gap: The End "A candle loses nothing by lighting another candle Dr. Sharif M. Abu Karsh

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock