Question: Question No. 1 What do you mean by systematic and Unsystematic risk? What will be the effect of diversification on the systematic and unsystematic risk?

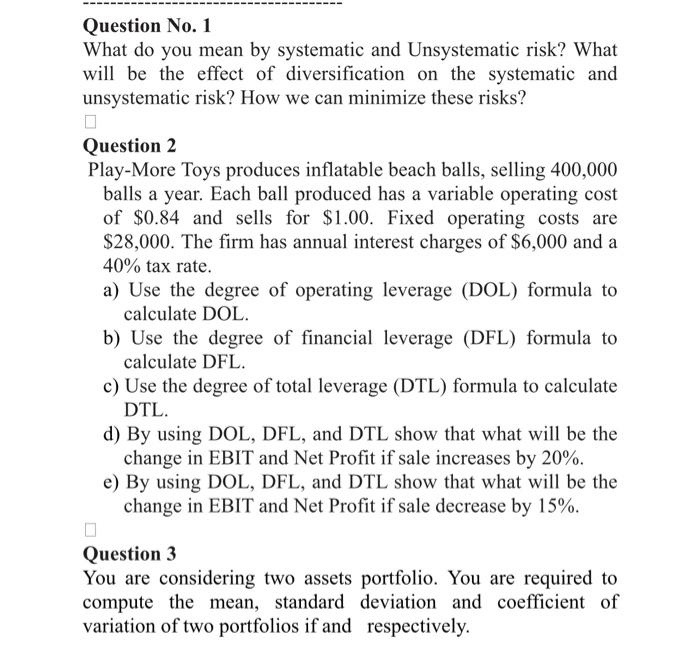

Question No. 1 What do you mean by systematic and Unsystematic risk? What will be the effect of diversification on the systematic and unsystematic risk? How we can minimize these risks? Question 2 Play-More Toys produces inflatable beach balls, selling 400,000 balls a year. Each ball produced has a variable operating cost of $0.84 and sells for $1.00. Fixed operating costs are $28,000. The firm has annual interest charges of $6,000 and a 40% tax rate. a) Use the degree of operating leverage (DOL) formula to calculate DOL. b) Use the degree of financial leverage (DFL) formula to calculate DFL. c) Use the degree of total leverage (DTL) formula to calculate DTL. d) By using DOL, DFL, and DTL show that what will be the change in EBIT and Net Profit if sale increases by 20%. e) By using DOL, DFL, and DTL show that what will be the change in EBIT and Net Profit if sale decrease by 15%. Question 3 You are considering two assets portfolio. You are required to compute the mean, standard deviation and coefficient of variation of two portfolios if and respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts