Question: Question No 3: (5+5=10 Marks) (Objectives of this case study) To understand the application of accounting principles in recording of financial transactions To analyze the

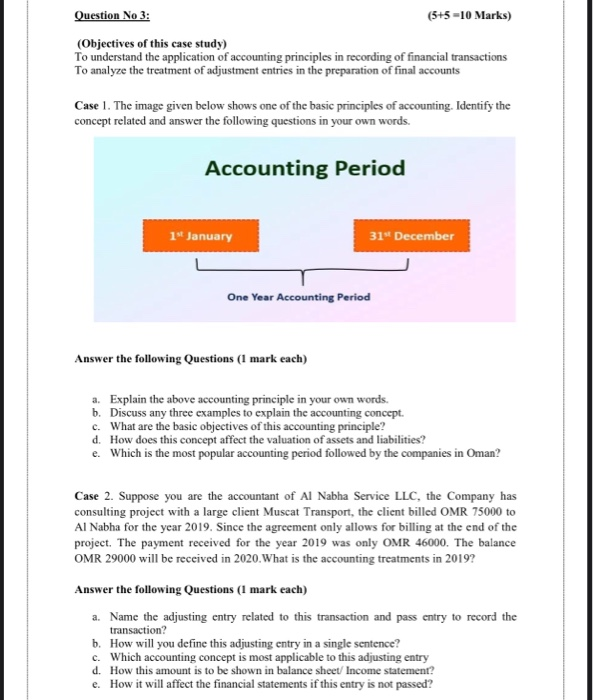

Question No 3: (5+5=10 Marks) (Objectives of this case study) To understand the application of accounting principles in recording of financial transactions To analyze the treatment of adjustment entries in the preparation of final accounts Case 1. The image given below shows one of the basic principles of accounting. Identify the concept related and answer the following questions in your own words. Accounting Period 1st January 31" December One Year Accounting Period Answer the following Questions (1 mark each) a. Explain the above accounting principle in your own words. b. Discuss any three examples to explain the accounting concept. c. What are the basic objectives of this accounting principle? d. How does this concept affect the valuation of assets and liabilities? e. Which is the most popular accounting period followed by the companies in Oman? Case 2. Suppose you are the accountant of Al Nabha Service LLC, the Company has consulting project with a large client Muscat Transport, the client billed OMR 75000 to Al Nabha for the year 2019. Since the agreement only allows for billing at the end of the project. The payment received for the year 2019 was only OMR 46000. The balance OMR 29000 will be received in 2020. What is the accounting treatments in 2019? Answer the following Questions (1 mark each) a. Name the adjusting entry related to this transaction and pass entry to record the transaction? b. How will you define this adjusting entry in a single sentence? c. Which accounting concept is most applicable to this adjusting entry d. How this amount is to be shown in balance sheet Income statement? e. How it will affect the financial statements if this entry is not passed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts