Question: Question No. 3 (8 marks) a. Why does the net present value method favor larger projects over smaller ones when used to choose between mutually

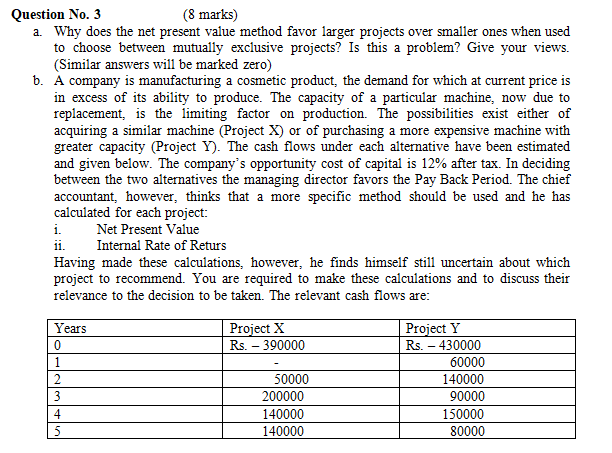

Question No. 3 (8 marks) a. Why does the net present value method favor larger projects over smaller ones when used to choose between mutually exclusive projects? Is this a problem? Give your views. (Similar answers will be marked zero) b. A company is manufacturing a cosmetic product, the demand for which at current price is in excess of its ability to produce. The capacity of a particular machine, now due to replacement, is the limiting factor on production. The possibilities exist either of acquiring a similar machine (Project X) or of purchasing a more expensive machine with greater capacity (Project Y). The cash flows under each alternative have been estimated and given below. The company's opportunity cost of capital is 12% after tax. In deciding between the two alternatives the managing director favors the Pay Back Period. The chief accountant, however, thinks that a more specific method should be used and he has calculated for each project: Net Present Value ii. Internal Rate of Returs Having made these calculations, however, he finds himself still uncertain about which project to recommend. You are required to make these calculations and to discuss their relevance to the decision to be taken. The relevant cash flows are: i. Years Project X Rs. - 390000 0 1 2 Project Y Rs. - 430000 60000 140000 90000 150000 80000 50000 200000 140000 140000 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts