Question: Question No. 3: Problem [2 x 7 = 14 Marks Part A: The Omani Company has two bond issues outstanding. Both bonds pay OMR (100)

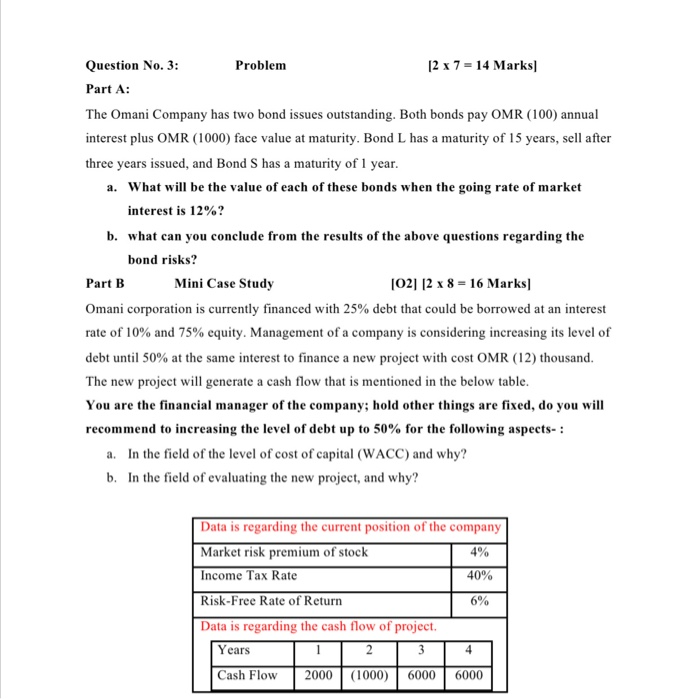

Question No. 3: Problem [2 x 7 = 14 Marks Part A: The Omani Company has two bond issues outstanding. Both bonds pay OMR (100) annual interest plus OMR (1000) face value at maturity. Bond L has a maturity of 15 years, sell after three years issued, and Bond S has a maturity of 1 year. a. What will be the value of each of these bonds when the going rate of market interest is 12%? b. what can you conclude from the results of the above questions regarding the bond risks? Part B Mini Case Study 0212 x 8 - 16 Marks] Omani corporation is currently financed with 25% debt that could be borrowed at an interest rate of 10% and 75% equity. Management of a company is considering increasing its level of debt until 50% at the same interest to finance a new project with cost OMR (12) thousand. The new project will generate a cash flow that is mentioned in the below table. You are the financial manager of the company; hold other things are fixed, do you will recommend to increasing the level of debt up to 50% for the following aspects-: a. In the field of the level of cost of capital (WACC) and why? b. In the field of evaluating the new project, and why? 4% Data is regarding the current position of the company Market risk premium of stock Income Tax Rate 40% Risk-Free Rate of Return 6% Data is regarding the cash flow of project Years 2 Cash Flow 2000 (1000) 6000 3 4 6000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts