Question: question no 3376474 ( please do not use hand writting) I need the answer as soon as possible Please. And I will Give Upvote Elfen

question no 3376474 ( please do not use hand writting) I need the answer as soon as possible Please. And I will Give Upvote

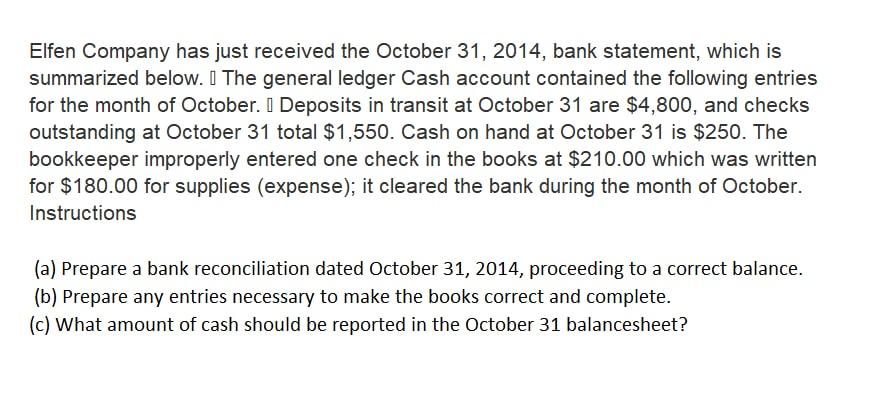

Elfen Company has just received the October 31, 2014, bank statement, which is summarized below. I The general ledger Cash account contained the following entries for the month of October. I Deposits in transit at October 31 are $4,800, and checks outstanding at October 31 total $1,550. Cash on hand at October 31 is $250. The bookkeeper improperly entered one check in the books at $210.00 which was written for $180.00 for supplies (expense); it cleared the bank during the month of October. Instructions (a) Prepare a bank reconciliation dated October 31, 2014, proceeding to a correct balance. (b) Prepare any entries necessary to make the books correct and complete. (c) What amount of cash should be reported in the October 31 balancesheet? Elfen Company has just received the October 31, 2014, bank statement, which is summarized below. I The general ledger Cash account contained the following entries for the month of October. I Deposits in transit at October 31 are $4,800, and checks outstanding at October 31 total $1,550. Cash on hand at October 31 is $250. The bookkeeper improperly entered one check in the books at $210.00 which was written for $180.00 for supplies (expense); it cleared the bank during the month of October. Instructions (a) Prepare a bank reconciliation dated October 31, 2014, proceeding to a correct balance. (b) Prepare any entries necessary to make the books correct and complete. (c) What amount of cash should be reported in the October 31 balancesheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts