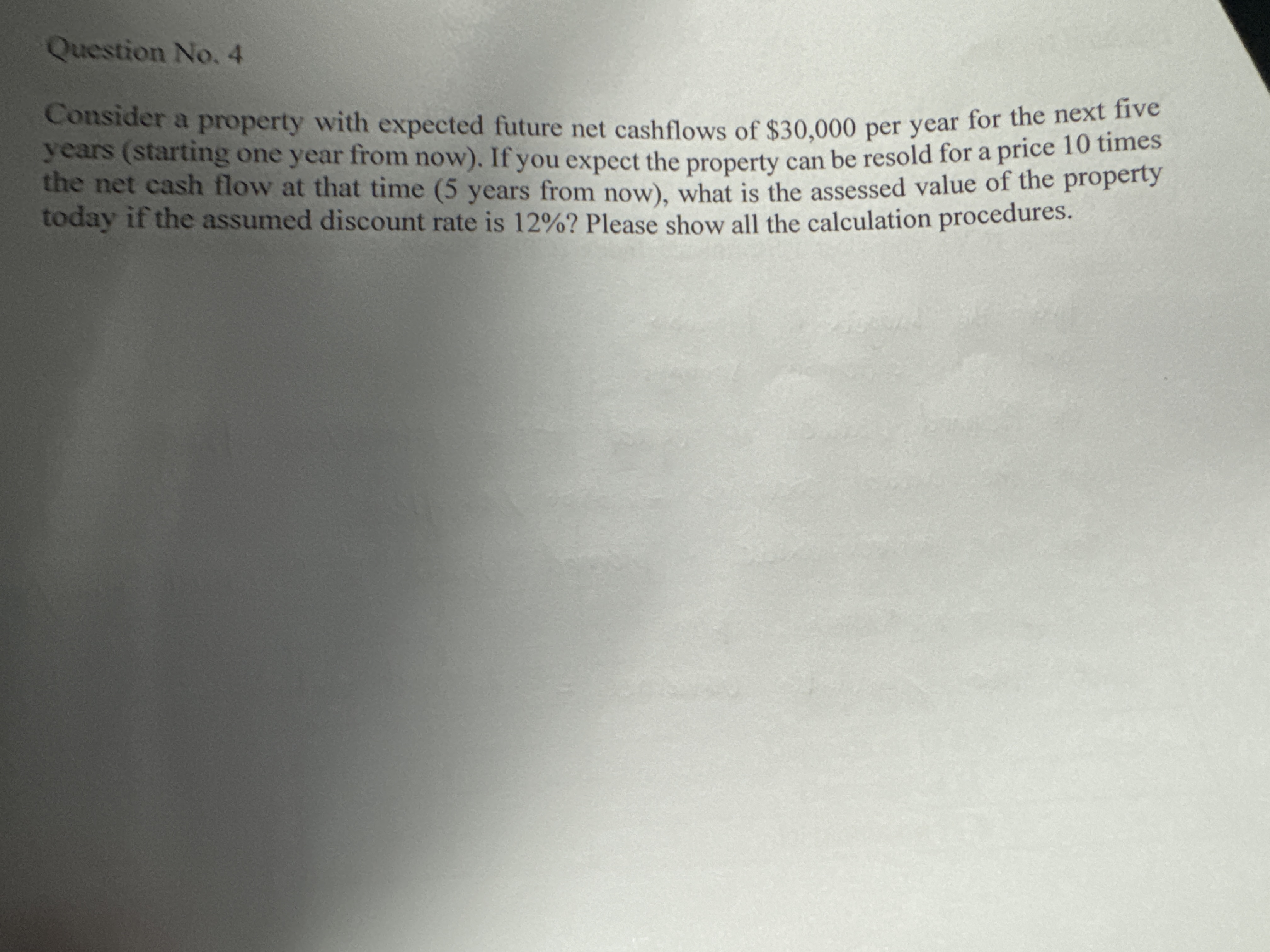

Question: Question No . 4 Consider a property with expected future net cashflows of $ 3 0 , 0 0 0 per year for the next

Question No

Consider a property with expected future net cashflows of $ per year for the next five

years starting one year from now If you expect the property can be resold for a price times

the net cash flow at that time years from now what is the assessed value of the property

today if the assumed discount rate is Please show all the calculation procedures.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock