Question: QUESTION NO 4 / IV PDE 4.jpeg (1).px POE 3.jpeg (1).p X PDF MID-TERM X + C File C:/Users/Givaldi/Dow... 6 of 6 Q + ...

QUESTION NO 4 / IV

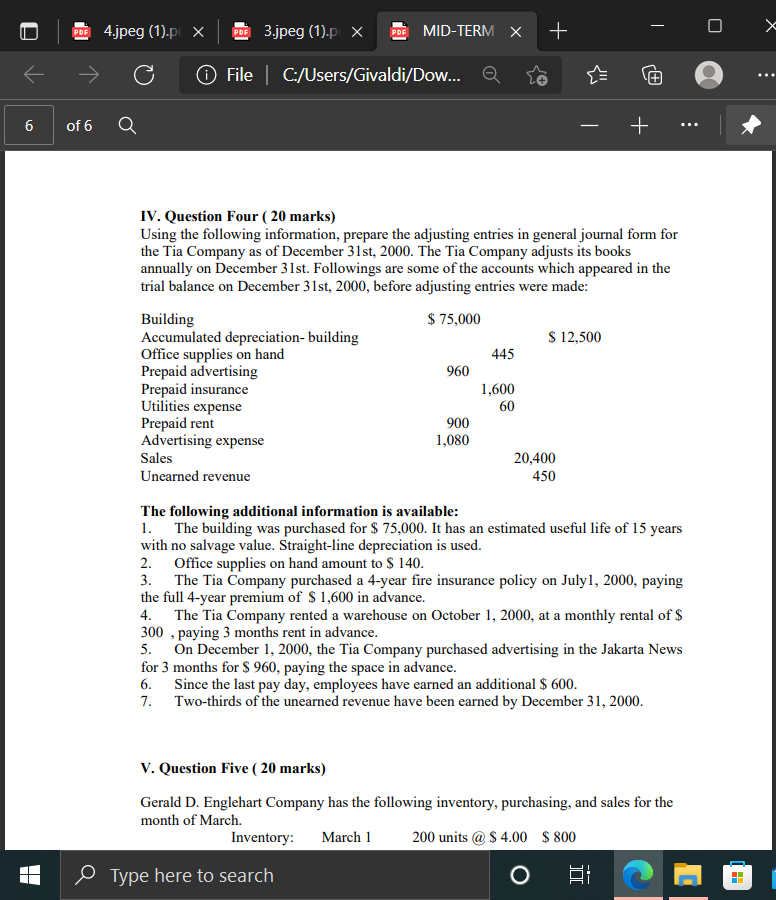

PDE 4.jpeg (1).px POE 3.jpeg (1).p X PDF MID-TERM X + C File C:/Users/Givaldi/Dow... 6 of 6 Q + ... IV. Question Four ( 20 marks) Using the following information, prepare the adjusting entries in general journal form for the Tia Company as of December 31st, 2000. The Tia Company adjusts its books annually on December 31st. Followings are some of the accounts which appeared in the trial balance on December 31st, 2000, before adjusting entries were made: Building $ 75,000 Accumulated depreciation- building $ 12,500 Office supplies on hand 445 Prepaid advertising 960 Prepaid insurance 1,600 Utilities expense 60 Prepaid rent 900 Advertising expense 1,080 Sales 20,400 Unearned revenue 450 The following additional information is available: 1. The building was purchased for $ 75,000. It has an estimated useful life of 15 years with no salvage value. Straight-line depreciation is used. 2. Office supplies on hand amount to $ 140. 3. The Tia Company purchased a 4-year fire insurance policy on July1, 2000, paying the full 4-year premium of $ 1,600 in advance. 4. The Tia Company rented a warehouse on October 1, 2000, at a monthly rental of $ 300 , paying 3 months rent in advance. 5. On December 1, 2000, the Tia Company purchased advertising in the Jakarta News for 3 months for $ 960, paying the space in advance. 6. Since the last pay day, employees have earned an additional $ 600. 7. Two-thirds of the unearned revenue have been earned by December 31, 2000. V. Question Five ( 20 marks) Gerald D. Englehart Company has the following inventory, purchasing, and sales for the month of March Inventory: March 1 200 units @ $ 4.00 $ 800 Type here to search BI E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts