Question: Question No. 5 a. When relevant project cash flows are examined, why is an increase in tax depreciation at first deducted and then later added

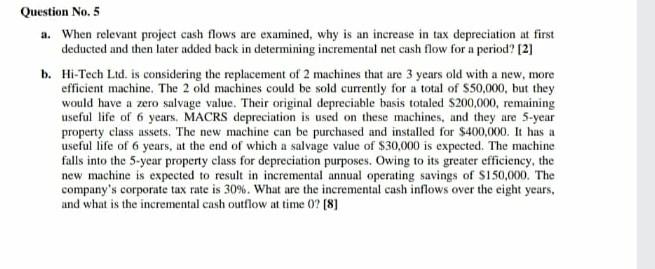

Question No. 5 a. When relevant project cash flows are examined, why is an increase in tax depreciation at first deducted and then later added back in determining incremental net cash flow for a period? [2] b. Hi-Tech Lid. is considering the replacement of 2 machines that are 3 years old with a new, more efficient machine. The 2 old machines could be sold currently for a total of $50,000, but they would have a zero salvage value. Their original depreciable basis totaled $200,000, remaining useful life of 6 years. MACRS depreciation is used on these machines, and they are 5-year property class assets. The new machine can be purchased and installed for $400,000. It has a useful life of 6 years, at the end of which a salvage value of $30,000 is expected. The machine falls into the 5-year property class for depreciation purposes. Owing to its greater efficiency, the new machine is expected to result in incremental annual operating savings of S150,000. The company's corporate tax rate is 30%. What are the incremental cash inflows over the eight years, and what is the incremental cash outflow at time 07 [8]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts