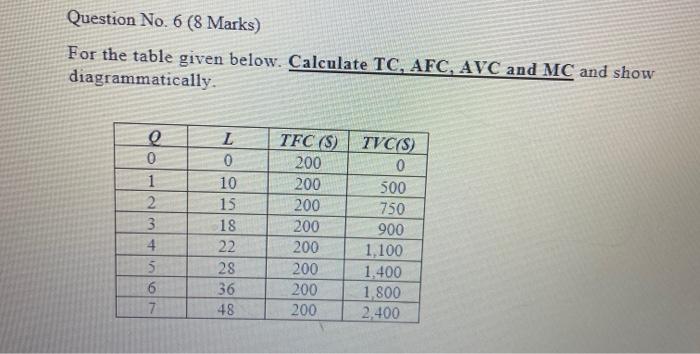

Question: Question No. 6 (8 Marks) For the table given below. Calculate TC, AFC, AVC and MC and show diagrammatically. 0 1 2 3 4. 5

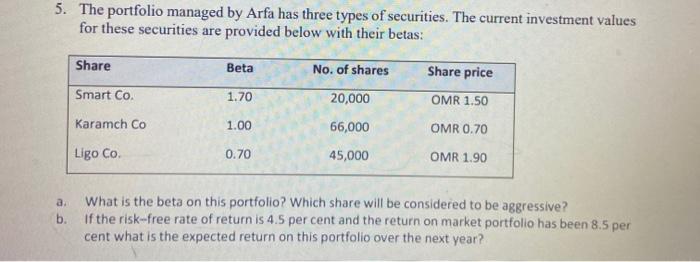

Question No. 6 (8 Marks) For the table given below. Calculate TC, AFC, AVC and MC and show diagrammatically. 0 1 2 3 4. 5 6 7 L 0 10 15 18 22 28 36 48 TFC (S) 200 200 200 200 200 200 200 200 TVC(S) 0 500 750 900 1,100 1.400 1,800 2.400 5. The portfolio managed by Arfa has three types of securities. The current investment values for these securities are provided below with their betas: Share Beta No. of shares Share price Smart Co. 1.70 20,000 OMR 1.50 Karamch Co 1.00 66,000 OMR 0.70 Ligo Co. 0.70 45,000 OMR 1.90 a. What is the beta on this portfolio? Which share will be considered to be aggressive? b. If the risk-free rate of return is 4.5 per cent and the return on market portfolio has been 8.5 per cent what is the expected return on this portfolio over the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts