Question: QUESTION NO:2 Consider a one period binomial Model in which the underlying stock price is BD: 110 and can go up to 30% or down

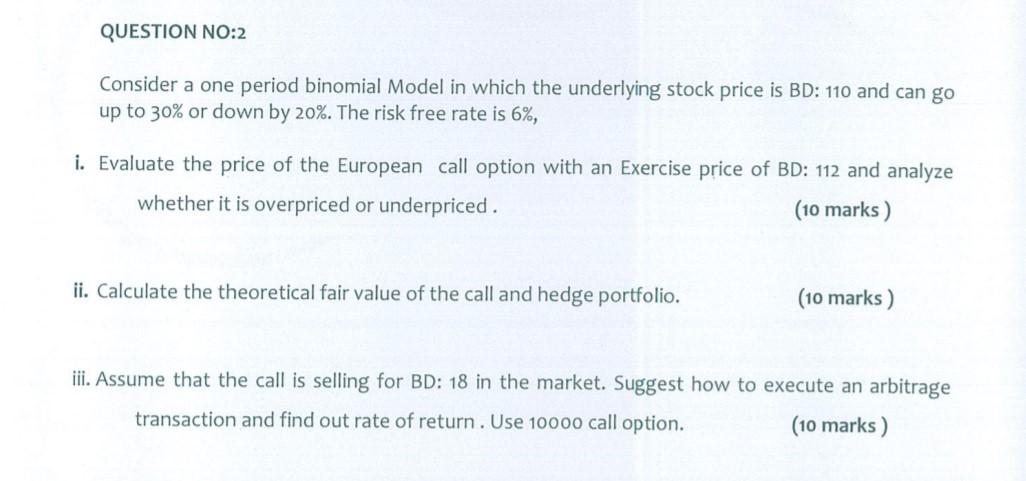

QUESTION NO:2 Consider a one period binomial Model in which the underlying stock price is BD: 110 and can go up to 30% or down by 20%. The risk free rate is 6%, i. Evaluate the price of the European call option with an Exercise price of BD: 112 and analyze whether it is overpriced or underpriced. (10 marks) ii. Calculate the theoretical fair value of the call and hedge portfolio. (10 marks) iii. Assume that the call is selling for BD: 18 in the market. Suggest how to execute an arbitrage transaction and find out rate of return. Use 10000 call option. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts