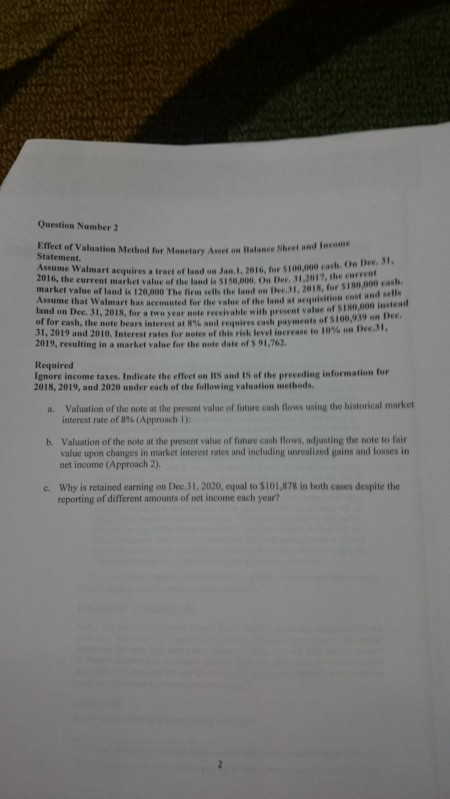

Question: Question Number 2 Effect of Valuation Method for Monetary Asset on Balance Sheet and Income Statement. Assume Walmart aequires a tr 2016, the current market

Question Number 2 Effect of Valuation Method for Monetary Asset on Balance Sheet and Income Statement. Assume Walmart aequires a tr 2016, the current market value ef the Innd , 5150,000On Dec. 31 ,2017, " market value of land is 120,000 The firm sells the land on Dee.31, 201, for stha Assume that Walmart has accounted for the value of the land at aequisitien land on Dee. 31, 2018, for a two year sote receivable with present value of SIN of for eash, the note bears interest n1 8% and requires cash, payments 1 31, 2019 and 2010. Interest rates for notes ofthin.h levet increase to 10% on leesi. 2019, resulting in a market value for the note date of 5 91,762 act of land on Jan.1, 2016, for $100,000 eash, On Dee. 31 cost and sells f 5100,939 on Dee. Required Ignore income taxes. Indicate the effect on 1BS and IS of the preceding information for 2018, 2019, and 2020 under each of the following valuation methods. Valuation of the note at the present value of future cash flows using the historical market interest rate of 8% ( Approach 1 ): a. Valuation of the note at the present value of future cash flows, adjusting the note to fair value upon changes in market interest rates and including unrealized gains and losses in net income (Approach 2). b. Why is retained earning on Dec.31, 2020, equal to 5101,878 in both cases despite the reporting of different amounts of net income each year? e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts