Question: question number 2 please Due on April 6th, 2020 in class. 1. Assume you have the following information: USD/MXN -18.51/18.52 and USD/NZD -1.2965/1.2969. Calculate NZD/MXP.

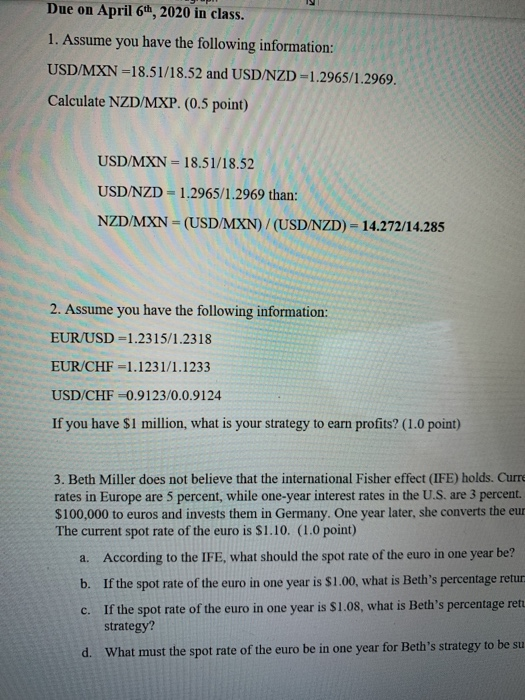

Due on April 6th, 2020 in class. 1. Assume you have the following information: USD/MXN -18.51/18.52 and USD/NZD -1.2965/1.2969. Calculate NZD/MXP. (0.5 point) USD/MXN = 18.51/18.52 USD/NZD = 1.2965/1.2969 than: NZD/MXN -(USD/MXN)/(USD/NZD) - 14.272/14.285 2. Assume you have the following information: EUR/USD =1.2315/1.2318 EUR/CHF =1.1231/1.1233 USD/CHF 0.9123/0.0.9124 If you have $1 million, what is your strategy to earn profits? (1.0 point) 3. Beth Miller does not believe that the international Fisher effect (IFE) holds. Curre rates in Europe are 5 percent, while one-year interest rates in the U.S. are 3 percent. $100,000 to euros and invests them in Germany. One year later, she converts the eur The current spot rate of the euro is $1.10. (1.0 point) a. According to the IFE, what should the spot rate of the euro in one year be? b. If the spot rate of the euro in one year is $1.00, what is Beth's percentage retur c. If the spot rate of the euro in one year is $1.08, what is Beth's percentage retu strategy? d. What must the spot rate of the euro be in one year for Beth's strategy to be su

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts