Question: question Number 3 and 4 CHAPTER 14 VALUING AND ACQUIRING A BUSINESS 52 2. Some issues in mergers and acquisitions. Comment on the following statements:

question Number 3 and 4

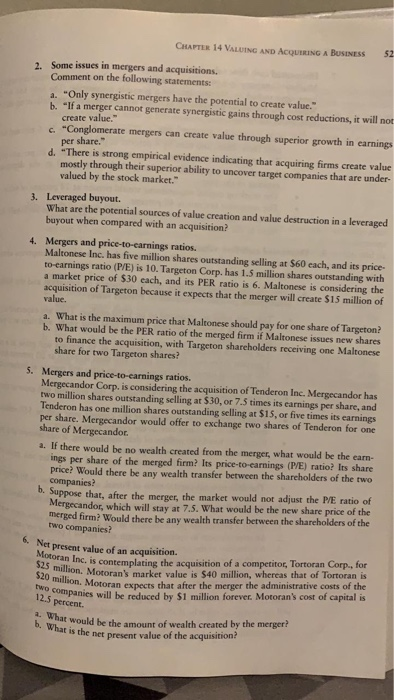

question Number 3 and 4CHAPTER 14 VALUING AND ACQUIRING A BUSINESS 52 2. Some issues in mergers and acquisitions. Comment on the following statements: a. "Only synergistic mergers have the potential to create value. b. "If a merger cannot generate synergistic gains through cost reductions, it will not create value." c. "Conglomerate mergers can create value through superior growth in earnings per share." d. "There is strong empirical evidence indicating that acquiring firms create value mostly through their superior ability to uncover target companies that are under valued by the stock market." 3. Leveraged buyout. What are the potential sources of value creation and value destruction in a leveraged buyout when compared with an acquisition? 4. Mergers and price-to-carnings ratios. Maltonese Inc. has five million shares outstanding selling at $60 each, and its price to earnings ratio (PE) is 10. Targeton Corp. has 1.5 million shares outstanding with a market price of $30 each, and its PER ratio is 6. Maltonese is considering the acquisition of Targeton because it expects that the merger will create $ 15 million of value. a. What is the maximum price that Maltonese should pay for one share of Targeton? b. What would be the PER ratio of the merged firm if Maltonese issues new shares to finance the acquisition, with Targeton shareholders receiving one Maltonese share for two Targeton shares? 5. Mergers and price-to-earnings ratios. Mergecandor Corp. is considering the acquisition of Tenderon Inc. Mergecandor has two million shares outstanding selling at $30, or 7.5 times its earnings per share, and Tenderon has one million shares outstanding selling at $15, or five times its earnings per share. Mergecandor would offer to exchange two shares of Tenderon for one share of Mergecandot. a. If there would be no wealth created from the merger, what would be the car. ings per share of the merged firm? Its price-to-earnings (P/E) ratio? Its share price? Would there be any wealth transfer between the shareholders of the two companies? Suppose that, after the merger, the market would not adjust the ME ratio of Mergecandor, which will stay at 7.5. What would be the new share price of the merged firm? Would there be any wealth transfer between the shareholders of the two companies? Net present value of an acquisition oran Inc. is contemplating the acquisition of a competitor, Tortoran Corp., for million. Motoran's market value is $40 million, whereas that of Tortoran is hion, Motoran expects that after the merger the administrative costs of the companies will be reduced by $1 million forever. Motoran's cost of capital is 12.5 percent at would be the amount of wealth created by the merger? what is the net present value of the acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts