Question: question number 4 & 5 is what I need help completing. 1st row in #4 is correct Numbers 1-3 are correct. There is some Information

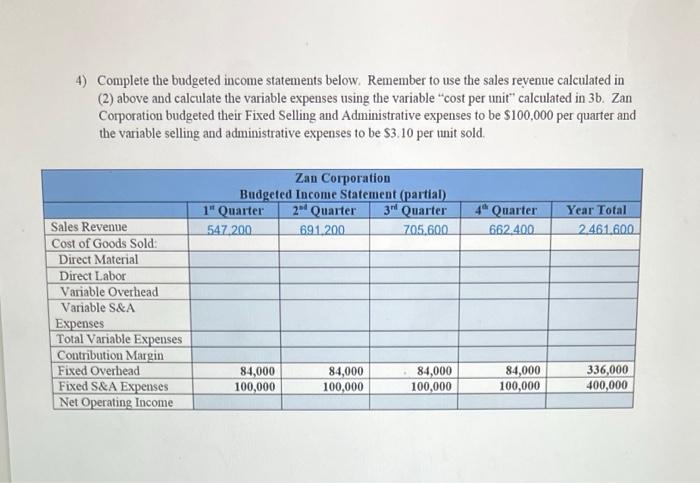

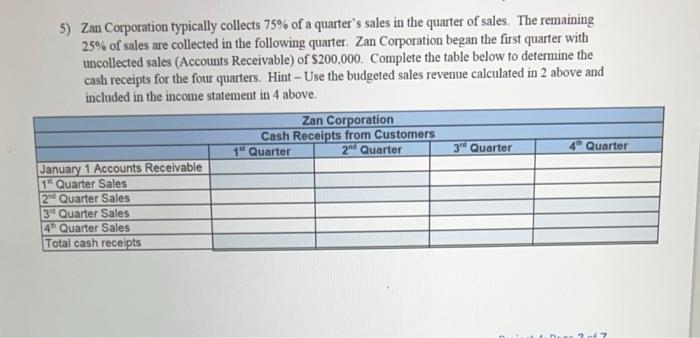

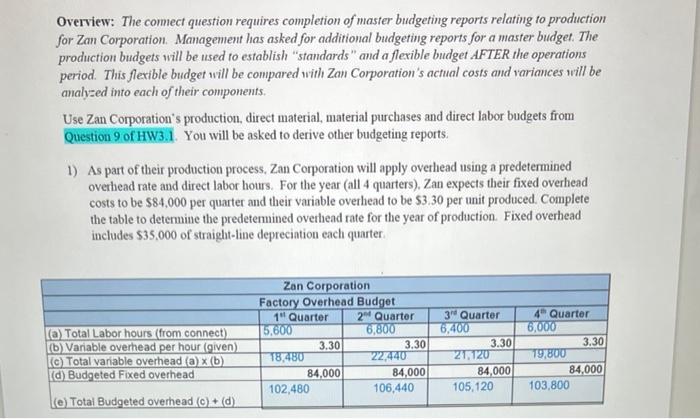

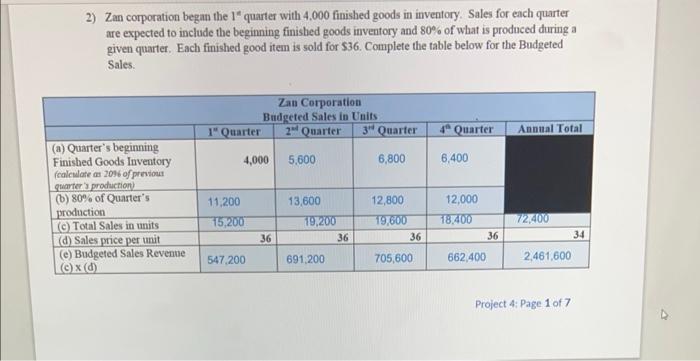

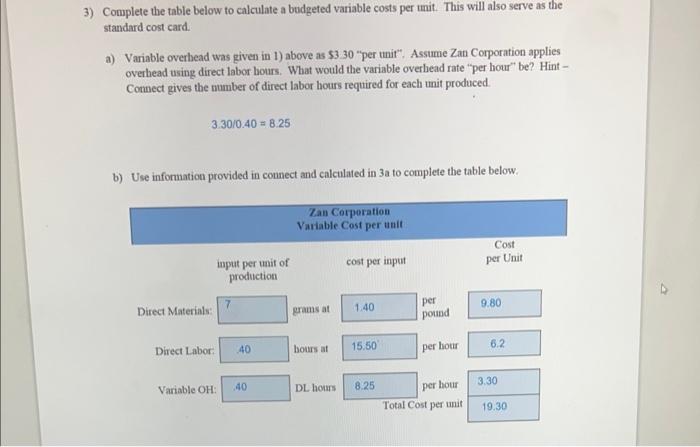

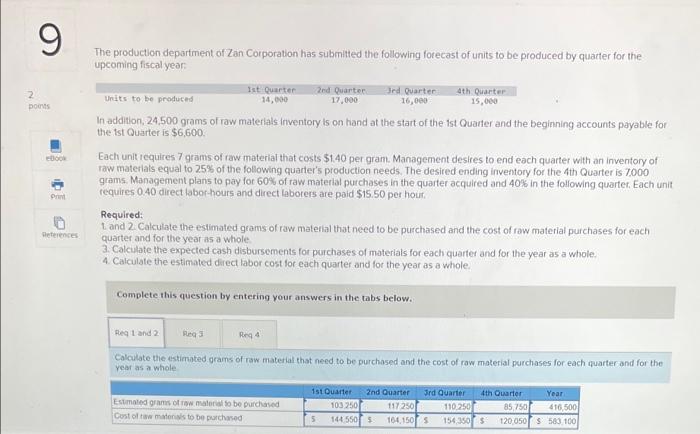

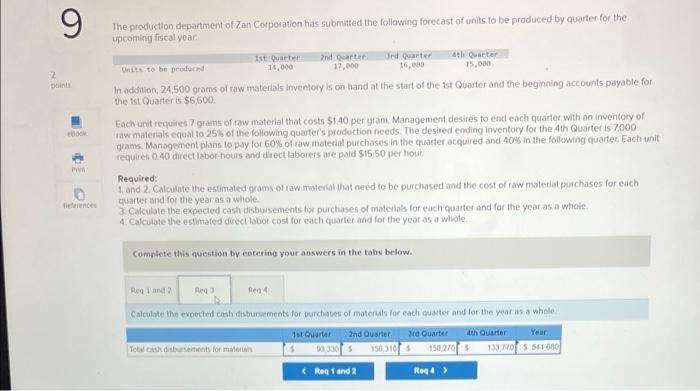

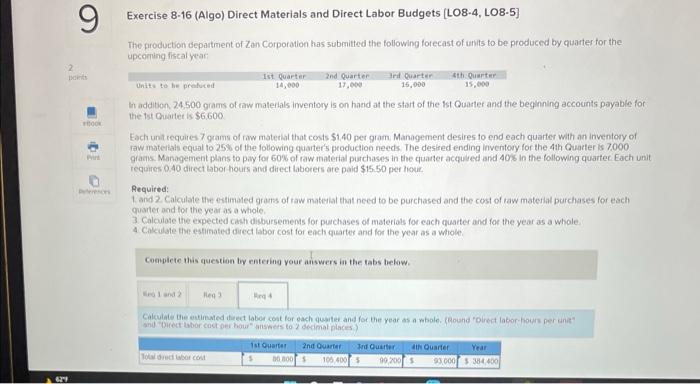

4) Complete the budgeted income statements below. Remember to use the sales revenue calculated in (2) above and calculate the variable expenses using the variable "cost per unit" calculated in 3b. Zan Corporation budgeted their Fixed Selling and Administrative expenses to be $100,000 per quarter and the variable selling and administrative expenses to be $3.10 per unit sold. 5) Zan Corporation typically collects 75% of a quarter's sales in the quarter of sales. The remaining 25% of sales are collected in the following quarter. Zan Corporation began the first quarter with uncollected sales (Accounts Receivable) of $200,000. Complete the table below to determine the cash receipts for the four quarters. Hint - Use the budgeted sales revenue calculated in 2 above and included in the income statement in 4 above. Overview: The commect question requires completion of master budgeting reports relating to production for Zan Corporation. Management has asked for additional budgeting reports for a master budget. The production budgets will be used to establish "standards" and a flexible budget AFTER the operations period. This flexible budget will be compared with Zan Corporation's actual costs and variances will be analyzed into each of their components. Use Zan Corporation's production, direct material, material purchases and direct labor budgets from Question 9 of HW3.1. You will be asked to derive other budgeting reports. 1) As part of their production process. Zan Corporation will apply ovethead using a predetermined overhead rate and direct labor hours. For the year (all 4 quarters). Zan expects their fixed overhead costs to be $84.000 per quarter and their variable overhead to be $3.30 per unit produced. Complete the table to determine the predetermined overhead rate for the year of production. Fixed overhead includes $35,000 of straight-line depreciation each quarter. 2) Zan corporation began the 1" quarter with 4.000 finished goods in inventory. Sales for each quarter are expected to include the beginning finished goods inventory and 80% of what is produced during a given quarter. Each finished good item is sold for $36. Complete the table below for the Budgeted Sales. Project 4: Page 1 of 7 3) Complete the table below to calculate a budgeted variable costs per unit. This will also serve as the standard cost card. a) Variable overhead was given in 1) above as $3.30 "per unit". Assume Zan Corporation applies overhead using direct labor hours. What would the variable overhead rate "per hour" be? Hint Connect gives the number of direct labor hours required for each unit produced. 3.30/0.40=8.25 b) Use information provided in connect and calculated in 3 a to complete the table below. The production department of Zan Corporation has submitted the following forecast of units to be produced by quatter for the upcoming fiscal year: In addition, 24,500 grams of raw materlals inventory is on hand at the start of the ist Quarter and the beginning accounts payable for the ist Quarter is $6,600. Each unit requires 7 grams of raw material that costs $1.40 per gram. Management desires to end each quarter with an inventory of raw materlats equal to 25% of the following quarter's production needs. The desired ending inventory for the 4 th Quarter is 7,000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.40 direct laborhours and direct laborers are paid $15.50 per hour, Required: 1. and 2 Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated diect labor cost for each quarter and for the year as a whole Complete this question by entering your answers in the tabs below. Calculate the estimated orams of raw materal that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole The production department of Zan Cotporation has submatted the following forecast of units to be produced by quarter for the upcoming fiscal year In addition, 24,500 grams of raw materials irventory is on hand at the start of the 1st Quater and the beginning accounts payable for the tst Quarter is $6,600. Each unit requires 7 grams of raw material that costs $1.40 per gram. Management desires to end each quarter with an irventory of 1aw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4 th Quarter is 7,000 grams. Management plans to pay for 60% of raw material purchases in the quarter ocquired and 400 in the follewing quarter. Each unit requires 0.40 direct laborthours and direct laborers are paid $15.50 per hour. Required: 1. and 2. Calculute the estimated grams of raw material that need to be purchased and the cost of raw materlal parchases for each quarter and for the year as a whole 3. Calculate the expected cash disbursements for purchases of mateviaks for each quarter and for the year as a whole. 4. Calculate the estimated direct labot cost for each quarter and for the year as a whoie. Complete this question by entering your answers in the tabs below. Caiculate the evpected cashdrobursements for purchases of materials for each quater and for the year as a whele Exercise 8-16 (Algo) Direct Materials and Direct Labor Budgets [LO8-4, LO8-5] The production depatment of Zan Corporation has submitted the following forecast of anits to be produced by quarter for the upcoming fiscal year In addition. 24,500 grams of taw materals imventory is on harid at the start of the ist Quater and the beginning accocints payabie for the 1st Guartet is $6,600 Each unt requires 7 gams of row material that costs $1.40 per pram. Management desires to end each quarter with an inventory of raw mateltals equal to 25% of the following quarter's production needs. The destred ending inventory for the 4 th Cuarter is 7.000 graass. Management plans to pay for 60% of raw material purchases in the quater acquised and 40 s in the following quarter Each unit requires 0.40 direct labor-hours and direct laborers are paid $1550 per houic. Required: L and 2. Calculate the entimased grams of raw material that need to be purchased and the cost of taw matesial purchases for each quater and for the year as a whole. 3 Calculate the expected cah disbursemens for purchases of materials for each quarter and for the year as a whole. 4. Cakedate the estinated drect labor cost for ench quarter and for the wear as a whole. Coepicte this question ty entering your answers in the tabs helow. anif irect tabor coct pei hour "anspers to 2 derimal pilaces

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts