Question: QUESTION NUMBER 8 EXHIBIT 2 ANSWER THE FOLLOWING QUESTION BASED ON EXHIBIT 2 8. Company A and Company B operate in the same industry. Company

QUESTION NUMBER 8 EXHIBIT 2

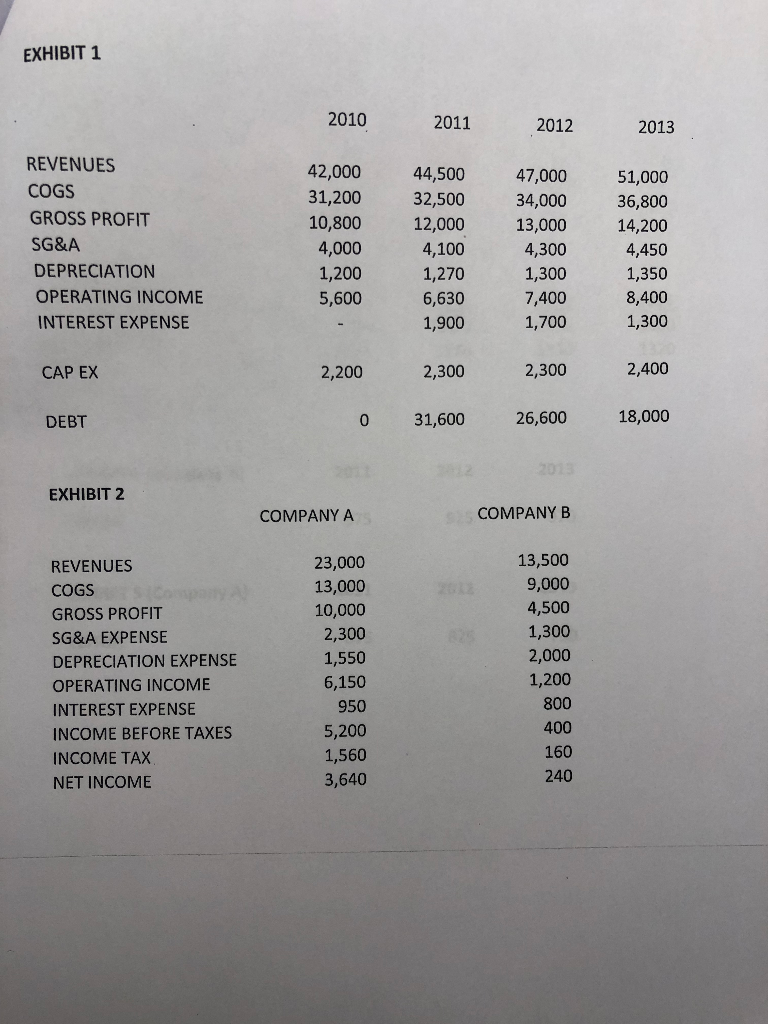

ANSWER THE FOLLOWING QUESTION BASED ON EXHIBIT 2 8. Company A and Company B operate in the same industry. Company A is sold for $69,300. Based on this, what is the value of Company B? ANSWER THE FOLLOWING QUESTION BASED ON EXHIBIT 3 9. Both company A and Company B were purchased at the end of 2011 for a 5x EBITDA multiple and financed with $3,000 of debt. Based on the information provided, which company is likely to have a higher equity valuation at the end of 2014. Explain your reasoning (hint: one of the companies likely paid down more debt) ANSWER THE FOLLOWING QUESTIONS BASED ON EXHIBIT 4 10. Assume that Company A was sold at the end of 2011 for a 5.5x multiple of EBITDA, and the purchase price was financed in part with $3,500 of debt. If the company is sold at the end of 2013 for this same 5.5x multiple, what is the equity return (assuming no debt paydown). 11, Make all the same assumptions as you did in #10, but assume that the initial purchase was only financed with $1,000 of debt. What is the equity return in this case assuming no debt paydown? EXHIBIT 1 2010 2011 2012 2013 42,000 4500 47,000 51,000 REVENUES COGS GROSS PROFIT SG&A DEPRECIATION OPERATING INCOME INTEREST EXPENSE 31,200 32,500 34,000 36,800 10,800 12,000 13,000 14,200 4,450 1,350 8,400 1,300 4,000 1,200 5,600 4,100 1,270 6,630 1,900 4,300 1,300 7,400 1,700 CAP EX 2,200 2,300 2,300 2,400 DEBT 0 31,600 26,600 18,000 EXHIBIT 2 COMPANY A COMPANY B REVENUES COGS GROSS PROFIT SG&A EXPENSE DEPRECIATION EXPENSE OPERATING INCOME INTEREST EXPENSE INCOME BEFORE TAXES INCOME TAX NET INCOME 23,000 13,000 10,000 2,300 1,550 6,150 950 5,200 ,560 3,640 13,500 9,000 4,500 1,300 2,000 1,200 800 400 160 240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts