Question: Question of > Moving to another question will save this response 10 points Save Answer Question 5 Piedmont Hotels is an all-equity firm with 50.000

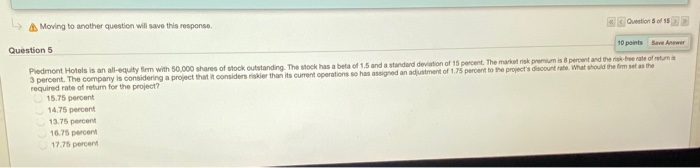

Question of > Moving to another question will save this response 10 points Save Answer Question 5 Piedmont Hotels is an all-equity firm with 50.000 shares of stock outstanding. The Mock has a bea of 1.5 and a standard deviation of 15 percent. The market risk premium is 8 percent and the street of returi 3 percent. The company is considering a project that it considers iskier than its current ecorations so has assigned an adjustment of 1.75 percent to the project's discount What should the first as the required rate of return for the project? 15.75 percent 14.75 percent 13.75 percent 16.75 percent 17.75 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock