Question: Question on current liabilites. Thanks Exercise 13-9 Green Day Hardware Company's payroll for November 2014 is summarized below Amount Subject to Payroll Taxes Unemployment Tax

Question on current liabilites. Thanks

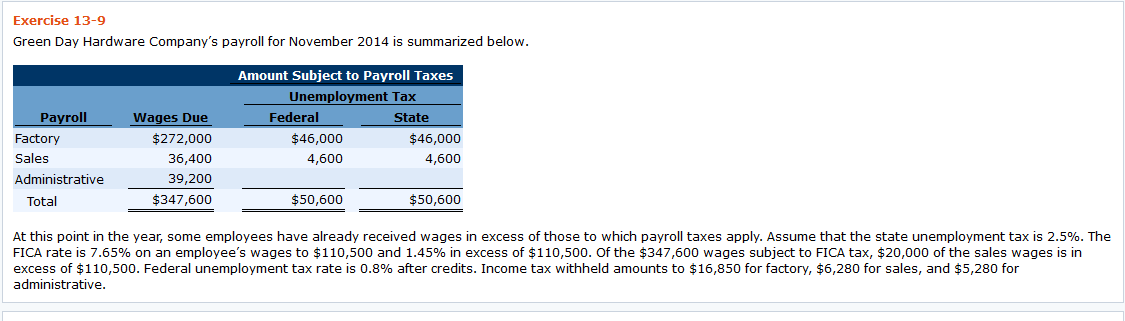

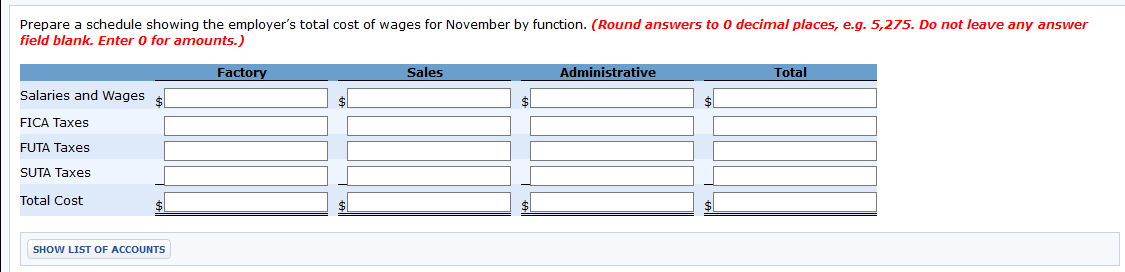

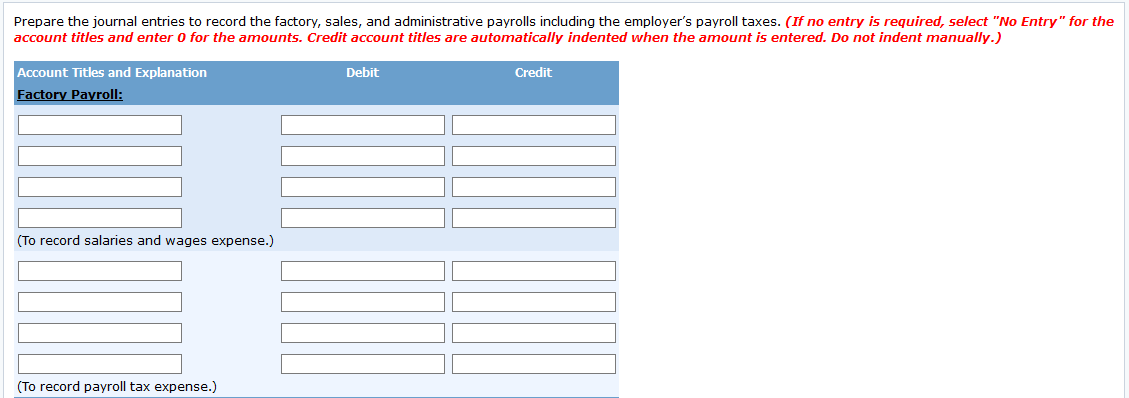

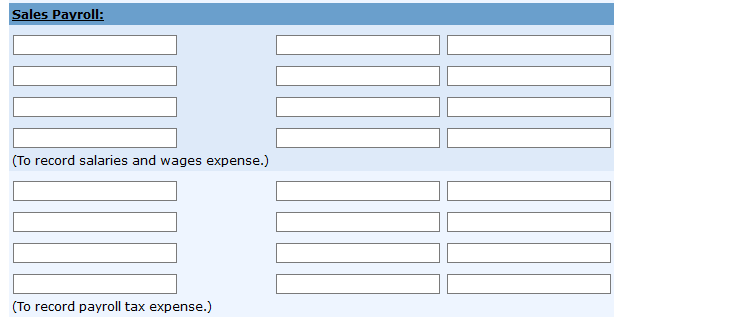

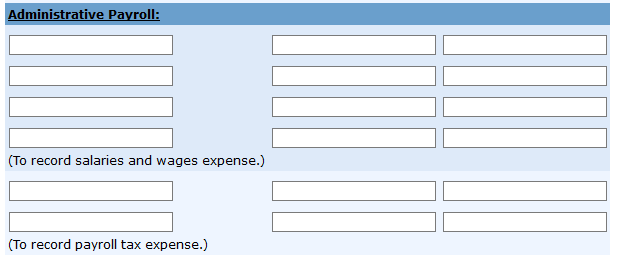

Exercise 13-9 Green Day Hardware Company's payroll for November 2014 is summarized below Amount Subject to Payroll Taxes Unemployment Tax Federal Payroll State Factory Sales Administrative Wages Due $272,000 36,400 39,200 $347,600 $46,000 4,600 $46,000 4,600 Total $50,600 $50,600 At this point in the year, some employees have already received wages in excess of those to which payroll taxes apply. Assume that the state unemployment tax is 2.5%. The FICA rate is 7.65% on an employee's wages to $110,500 and 1.45% in excess of $110,500. Of the $347,600 wages subject to FICA tax, $20,000 of the sales wages is in excess of $110,500. Federal unemployment tax rate is 0.8% after credits, Income tax withheld amounts to $16,850 for factory, $6,280 for sales, and $5,280 for administrative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts