Question: QUESTION ONE (30 Marks) a) The Campbell Company is evaluating the proposed acquisition for a new milling machine. The machine cost shillings 108,000/= and will

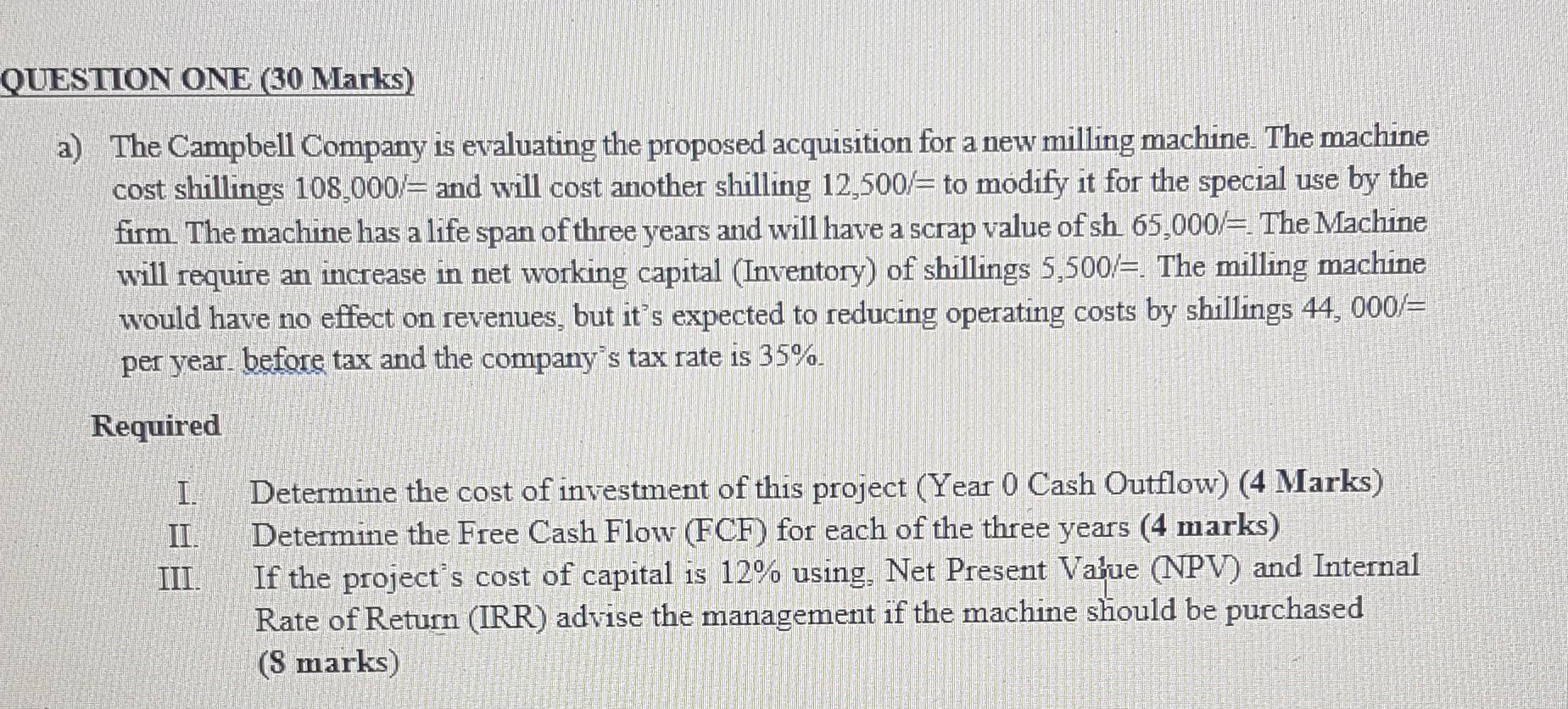

QUESTION ONE (30 Marks) a) The Campbell Company is evaluating the proposed acquisition for a new milling machine. The machine cost shillings 108,000/= and will cost another shilling 12,500/= to modify it for the special use by the firm The machine has a life span of three years and will have a scrap value of sh 65,000/=. The Machine will require an increase in net working capital (Inventory) of shillings 5,500/=. The milling machine would have no effect on revenues, but it's expected to reducing operating costs by shillings 44, 000/= per year. before tax and the company's tax rate is 35%. Required I. II. III. Determine the cost of investment of this project (Year 0 Cash Outflow) (4 Marks) Determine the Free Cash Flow (FCF) for each of the three years (4 marks) If the project's cost of capital is 12% using. Net Present Value (NPV) and Internal Rate of Return (IRR) advise the management if the machine should be purchased (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts