Question: QUESTION ONE ( 4 5 marks, 8 1 minutes ) Spring Meadow ( Pty ) Ltd is a resident manufacturing company that operates in the

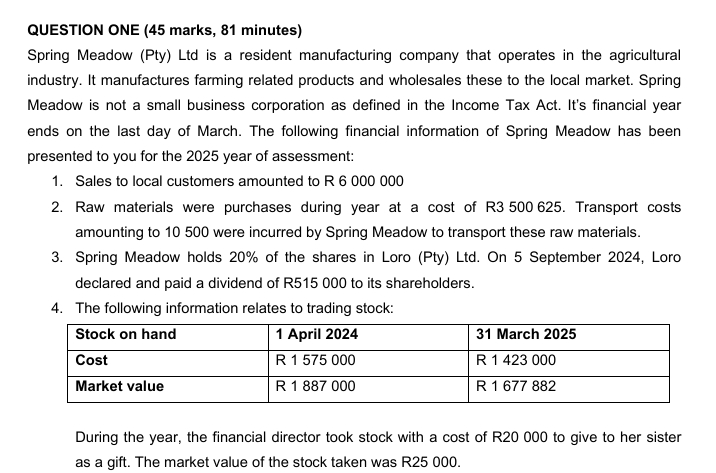

QUESTION ONE marks, minutes Spring Meadow Pty Ltd is a resident manufacturing company that operates in the agricultural industry. It manufactures farming related products and wholesales these to the local market. Spring Meadow is not a small business corporation as defined in the Income Tax Act. It's financial year ends on the last day of March. The following financial information of Spring Meadow has been presented to you for the year of assessment: Sales to local customers amounted to R Raw materials were purchases during year at a cost of R Transport costs amounting to were incurred by Spring Meadow to transport these raw materials. Spring Meadow holds of the shares in Loro Pty Ltd On September Loro declared and paid a dividend of R to its shareholders. The following information relates to trading stock: During the year, the financial director took stock with a cost of R to give to her sister as a gift. The market value of the stock taken was R

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock